Medtronic to Spin Off Diabetes Division Amid Quality Concerns and Low 2026 Earnings Outlook

Medtronic plc $MDT, a global leader in medical technology, announced plans to spin off its diabetes division into a standalone entity. The move, disclosed on Wednesday, comes amid persistent quality control and cybersecurity concerns that have plagued the unit in recent years. Alongside the restructuring, the company also issued a downbeat earnings projection for fiscal 2026, falling below market expectations.

This strategic realignment marks Medtronic’s ongoing effort to streamline operations and concentrate resources on its core, high-margin businesses—particularly in cardiac rhythm management, where devices like pacemakers deliver the bulk of its profits.

Business Unit Separation Follows Operational and Regulatory Pressure

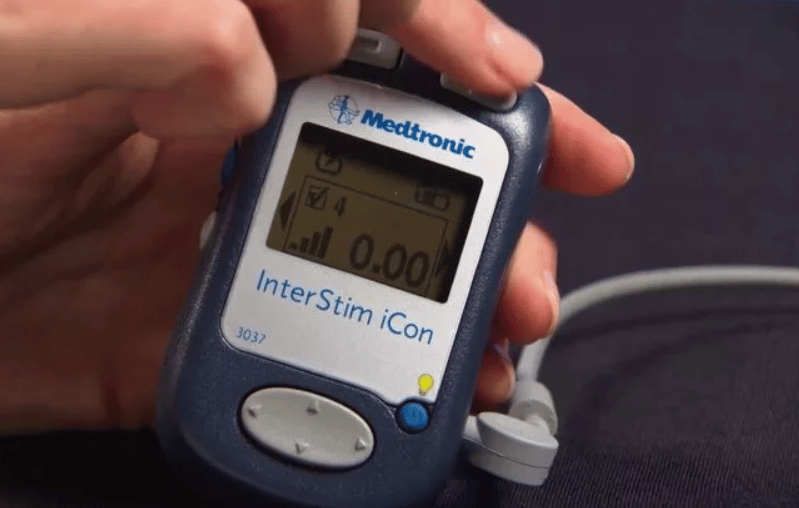

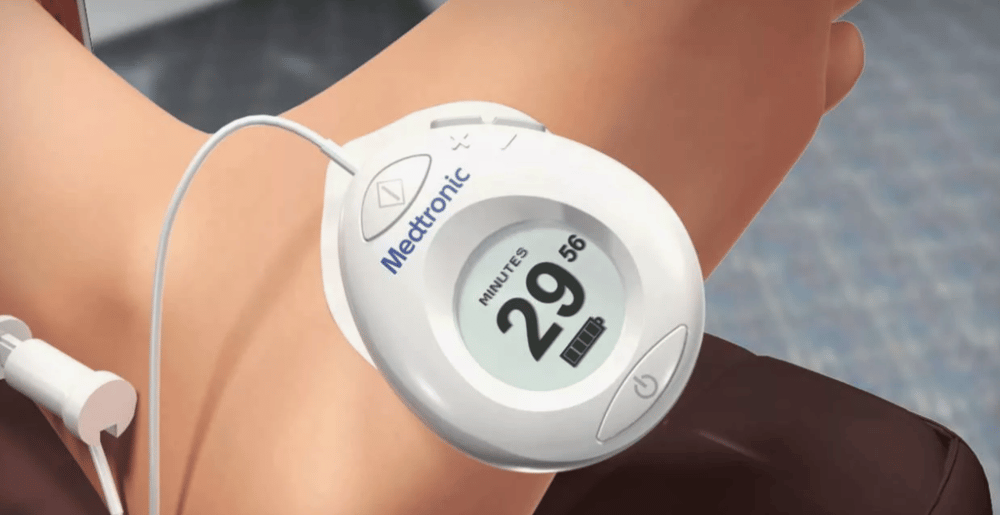

The diabetes division—responsible for insulin pumps and other wearable diabetes management solutions—has faced multiple setbacks, including regulatory scrutiny related to product quality and cybersecurity vulnerabilities. Analysts have noted that separating the division will allow Medtronic to shield its more stable segments from operational and reputational risks.

The new diabetes-focused company will inherit Medtronic's legacy in insulin delivery systems but will need to rebuild market confidence independently. Meanwhile, the parent company can sharpen its focus on growth areas less exposed to compliance burdens and product recalls.

Key Facts:

Spinoff Plan: Diabetes division to become a separate publicly traded company

Core Products Affected: Insulin pumps and wearable glucose management systems

Reason for Separation: Quality assurance and cybersecurity challenges

Future Focus: Cardiovascular devices, including pacemakers and defibrillators

Earnings Forecast: Adjusted EPS for FY2026 expected below analyst estimates

Market Response and Strategic Outlook

Investors reacted cautiously to the news, with MDT shares showing limited movement on the day of the announcement. While the spinoff could unlock long-term value, the lower-than-expected earnings guidance for 2026 raised concerns about near-term profitability.

The restructuring reflects a broader trend in the medtech industry toward specialization and leaner operating models. By exiting a low-margin, high-risk business segment, Medtronic positions itself to enhance operational efficiency and pursue targeted innovation in cardiovascular and surgical technologies.

Key Takeaways:

Strategic Realignment: The spinoff reflects a calculated pivot toward Medtronic’s more profitable product lines.

Financial Implications: Lower EPS guidance for FY2026 may weigh on investor sentiment in the short term.

Risk Management: Isolating the diabetes unit reduces exposure to recurring regulatory and cybersecurity issues.

Industry Trend: Medtronic joins peers like Johnson & Johnson (JNJ) in executing portfolio simplification.

Leadership Outlook: Management reiterated commitment to capital discipline and margin expansion post-restructuring.

Risk Reduction and Profit Optimization Drive Medtronic’s Latest Move

Medtronic’s decision to separate its diabetes business underscores the growing imperative for operational clarity and risk isolation in the healthcare technology sector. By offloading a troubled unit and narrowing its focus on high-yield categories, the company seeks to improve capital allocation, streamline compliance efforts, and enhance shareholder value.

While execution risk remains, especially regarding the diabetes unit’s independent trajectory, the overarching strategy aligns with market dynamics favoring specialization and targeted innovation over diversified exposure.

Comments

Automation is no longer a future concept—it's becoming a core driver of strategic value