Investing with innovation in mind is catalyzing significant capital growth across the tech sector

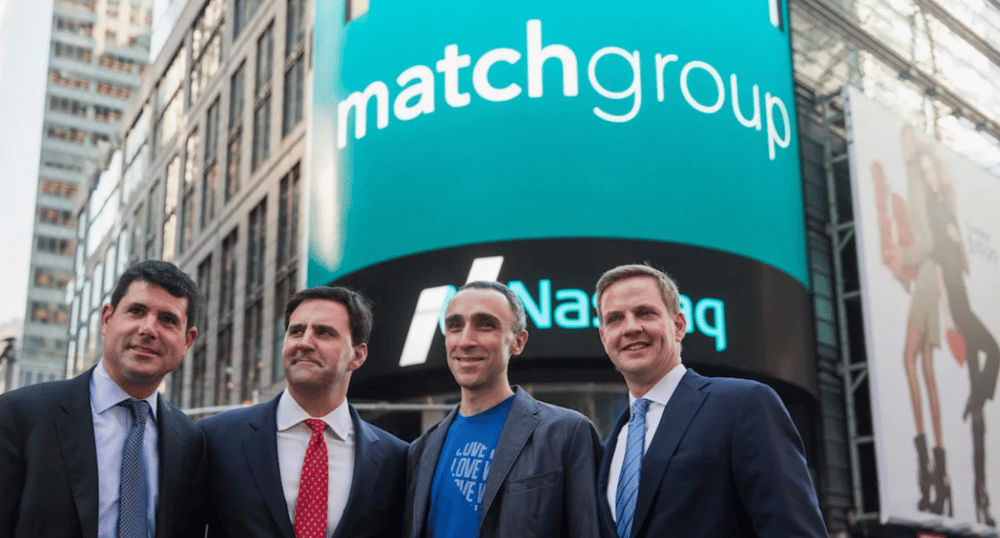

In a move that signals growing responsiveness to shareholder activism, Match Group Inc. $MTCH, a leading player in the online dating industry, has announced significant governance changes following pressure from Anson Funds. The $7.6 billion company will introduce a new board director with deep expertise in consumer technology and will transition to annual elections for all board members—two key concessions aimed at diffusing investor dissatisfaction.

Match Group disclosed on Tuesday that Kelly Campbell, the former president of NBCUniversal’s streaming platform Peacock, will join its board. Campbell’s addition is seen as a strategic move to strengthen digital consumer engagement expertise at the board level. Her appointment arrives as part of a broader settlement with Anson Funds, which had been pushing for a revamp of the company’s governance framework.

The hedge fund, which held approximately 0.6% of Match Group's shares as of late December, had nominated three directors in a bid to disrupt what it described as an “insular and outdated” board structure. Match’s agreement to adopt annual board elections represents a marked shift from its previous staggered election format—a system often criticized for entrenching leadership.

Strategic Board Realignment The addition of Campbell bolsters Match's focus on platform innovation and competitive positioning in the streaming and mobile tech space.

Anson’s Activist Influence Despite owning less than 1% of shares, Anson Funds leveraged corporate governance concerns to influence material change, reflecting a broader trend in shareholder activism.

Governance Overhaul in Motion The shift to annual board elections aligns Match with best practices in transparency and accountability, commonly favored by institutional investors.

Reputational Considerations Addressing the activist campaign without a proxy fight helps Match preserve its public image while demonstrating agility in corporate stewardship.

Investor Confidence and Market Optics By resolving the dispute amicably and proactively updating governance, Match positions itself to attract longer-term institutional capital.

Rise of ESG and governance scrutiny Shareholders are increasingly prioritizing board diversity, independence, and renewal mechanisms.

Digital leadership on the rise Campbell’s appointment underscores a shift toward directors with expertise in user acquisition, data monetization, and platform scalability.

Low ownership, high impact The Anson case exemplifies how even minority stakeholders can influence board dynamics through public advocacy and regulatory filings.

Pressure on peer firms Similar firms in the digital media and tech sectors may face renewed governance scrutiny following this development.

Streamlining shareholder engagement Annual elections foster direct accountability and reduce friction in future board nominations.

With Match Group under pressure to maintain relevance in a rapidly evolving digital dating landscape, modernizing its board may be just the first step. The move comes at a time when the company is facing intense competition from both legacy platforms and emerging apps with niche positioning and AI-driven matchmaking.

The governance shake-up could signal a more innovation-forward strategy and greater willingness to embrace outside perspectives—key traits for maintaining market leadership in an industry shaped by evolving user expectations and platform fatigue.