Keyera Corp. Expands Canadian Natural Gas Liquids Operations with $5.15 Billion Acquisition

Keyera Corp. $KEYUF, a leading energy infrastructure company based in Calgary, has announced a landmark acquisition of Plains' Canadian natural gas liquids (NGL) business, along with select U.S. assets, for a total of $5.15 billion. This move marks one of the most significant consolidation efforts in North America’s midstream sector in recent years and is set to reshape the NGL logistics landscape across Canada.

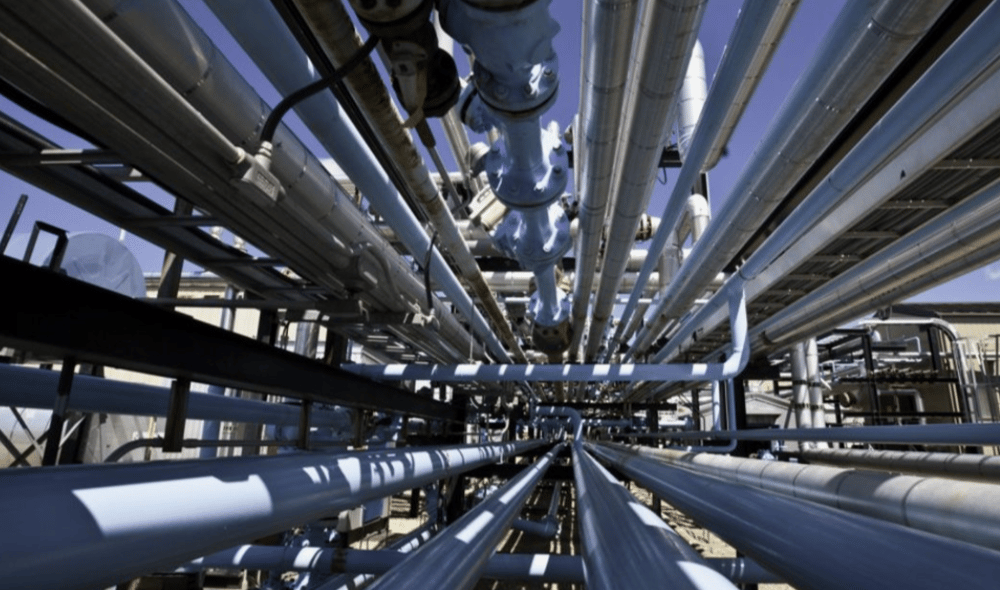

⚙️ Expansion of Liquids Infrastructure Across Western and Eastern Canada

The acquisition will bolster Keyera’s midstream footprint by integrating a full-cycle NGL value chain—ranging from extraction and transportation to storage and distribution. The newly acquired portfolio spans key provinces including Alberta, Saskatchewan, Manitoba, and Ontario, and includes:

Natural gas liquids extraction plants

Underground and aboveground storage facilities

Key pipeline infrastructure

Truck and rail terminals

The transaction supports Keyera’s long-term strategy to become a vertically integrated liquids logistics provider. By connecting western Canadian supply basins to high-demand markets in the east, the company strengthens its resilience to commodity price fluctuations and diversifies its revenue streams.

📌 Key Facts:

✅ Acquisition cost: $5.15 billion

✅ Assets span Alberta, Saskatchewan, Manitoba, Ontario

✅ Includes extraction, storage, pipelines, truck & rail terminals

✅ Enhances NGL value chain integration

✅ Strengthens Keyera’s position in North America’s midstream energy market

📊 Market Reaction and Expert Commentary

Investors and analysts have responded positively to the acquisition, with many citing its strategic alignment with Keyera’s growth ambitions. The deal is expected to generate immediate cash flow and long-term synergies through operational efficiency, asset optimization, and economies of scale.

Equity analysts at multiple investment firms upgraded their outlook on Keyera shares, highlighting the transformative nature of the acquisition. The integration of Plains' NGL assets is forecasted to boost earnings before interest, taxes, depreciation, and amortization (EBITDA), enhance shareholder returns, and improve utilization rates across Keyera’s existing facilities.

Market observers also note the acquisition’s timing amid growing global demand for natural gas liquids—used in petrochemicals, transportation fuels, and industrial applications—particularly in Asia and North America.

🔑 Key Developments:

Strategic Fit: Strengthens Keyera’s infrastructure and market access

Vertical Integration: Full-cycle control from extraction to distribution

Geographic Expansion: From Alberta to Ontario across multiple NGL hubs

Financial Outlook: Expected EBITDA growth and operational synergies

Market Confidence: Positive analyst revisions and stock movement

🧾 A Transformative Move for Canada's NGL Supply Chain

Keyera Corp.’s $5.15 billion acquisition of Plains’ Canadian NGL business represents a decisive step in the evolution of Canada's energy infrastructure. By establishing an integrated corridor from western to eastern Canada, Keyera not only expands its asset base but also secures its role as a key player in North America’s evolving energy logistics network.

With long-term global demand for NGLs on the rise, the deal provides the company with both scale and flexibility to meet the shifting needs of industrial and petrochemical markets. The transaction underscores the increasing importance of infrastructure control and supply chain integration in a volatile energy environment.

Comments