JPMorgan Chase Ups Annual Fee on Sapphire Reserve to USD 795 Amid Premium Rewards Revamp

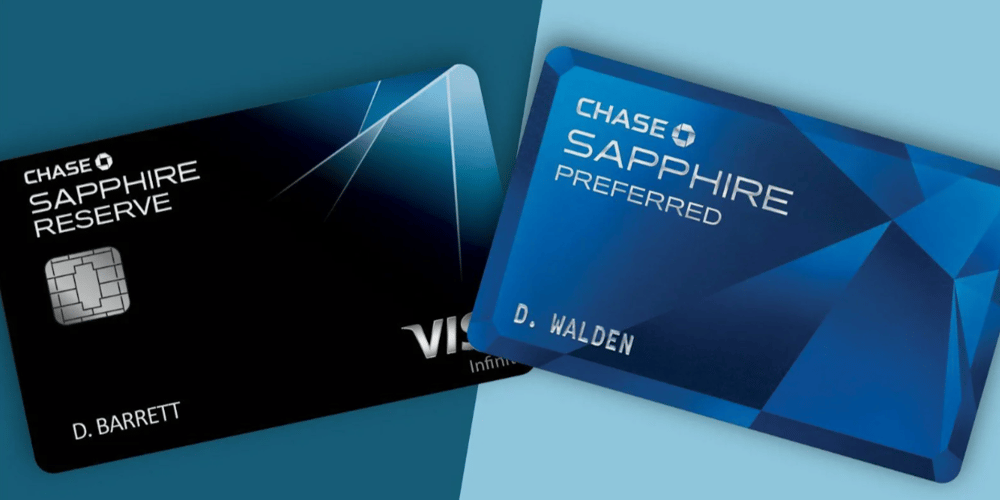

JPMorgan Chase & Co. $JPM has significantly overhauled its flagship Sapphire Reserve credit card, raising its annual fee by 45% to USD 795 while simultaneously expanding its suite of travel and lifestyle rewards. The move underscores a strategic bet that affluent U.S. consumers will continue to prioritize premium experiences, even amid tightening household budgets and shifting economic conditions.

The price increase marks the most substantial change to Sapphire Reserve’s fee structure since its launch in 2016. With competitive pressure mounting in the high-end credit card space, JPMorgan’s revamp seeks to retain and attract customers by substantially enhancing the card’s perceived and actual value.

More Expensive, But Packed With Value

The new annual fee of USD 795—up from the previous USD 550—is justified, according to JPMorgan, by over USD 2,700 in potential annual benefits tied to travel, dining, and lifestyle perks. These include revamped point-earning structures and additional redemption options aimed at high-spending, experience-oriented cardholders.

The update is seen as a response to changing post-pandemic travel habits, as consumers seek flexibility, personalization, and elevated services. The Sapphire Reserve’s enhanced offering also appears designed to fend off growing competition from other premium credit cards such as the American Express Platinum $AXP, which currently carries a USD 695 fee.

Key Facts:

🔹 Annual fee increase: From USD 550 to USD 795 (+45%)

🔹 Value of new and existing benefits: Over USD 2,700 per year

🔹 Card launch year: 2016

🔹 Category: Premium travel and lifestyle credit card

🔹 Issuer: JPMorgan Chase & Co.

Market Reactions and Expert Commentary

Market analysts suggest the move could reinforce JPMorgan’s positioning in the ultra-premium credit segment, where brand loyalty is closely linked to experiential value. By bundling enhanced rewards with increased flexibility in point redemption, the bank aims to boost customer retention and maximize cardholder engagement.

However, the fee hike could pose a psychological barrier for some consumers amid macroeconomic uncertainty. Still, JPMorgan appears confident that its affluent target base will view the benefits-to-cost ratio as favorable—particularly if they frequently utilize the card's travel, dining, and lifestyle perks.

Some analysts speculate that this signals a broader shift in the credit card industry toward “high fee, high value” offerings, particularly in the upper-income demographic, where churn is lower and spending is resilient.

Key Developments:

Bold Pricing Strategy — First major annual fee increase since 2016 reflects JPMorgan's confidence in the product's value proposition.

Reward Expansion — Enhanced travel and dining rewards align with post-pandemic consumer preferences.

Competitive Benchmarking — Positions the Sapphire Reserve card closer to rivals like AmEx Platinum.

Customer Retention Focus — Emphasizes experiential perks and lifestyle integration to deepen user loyalty.

Industry Signal — May influence future pricing strategies across premium credit card issuers.

High Risk, High Reward in the Premium Credit Space

JPMorgan Chase’s decision to raise the annual fee on the Sapphire Reserve to USD 795 represents a calculated risk, designed to capitalize on affluent consumers’ evolving expectations of value and exclusivity. By amplifying the benefit package to exceed USD 2,700 annually, the bank is betting that perceived value will outweigh price sensitivity among its core demographic.

This move not only redefines Sapphire Reserve’s position in the luxury credit market but also sets a precedent for how financial institutions may structure and price premium financial products in the future. While not without risks, especially during periods of economic uncertainty, the strategy underscores a clear pivot toward experience-driven loyalty in personal finance.

Comments