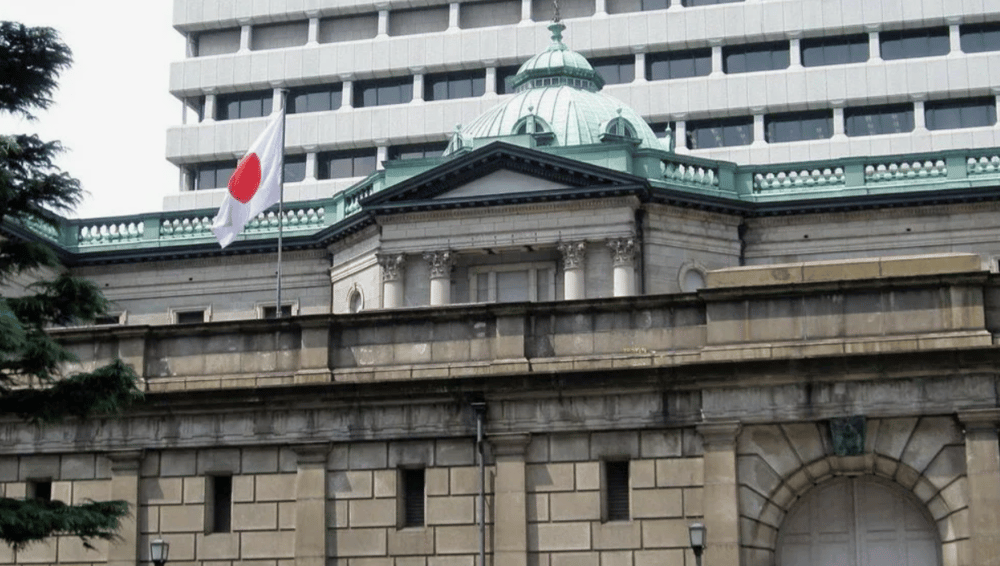

Japan’s MOF Signals Cut in Ultra-Long Bonds, Stabilizing Global Bond Markets Amid Inflation Concerns

Japan, known as one of the world’s most heavily indebted advanced economies, unexpectedly acted as a stabilizing force in global bond markets this week. Reports on Tuesday indicated that Japan’s Ministry of Finance (MOF) is considering reducing the issuance of ultra-long government bonds. This news sparked a positive reaction across international bond markets — from Japan and South Korea to the UK and the US — where bond prices rose and yields declined. The development paused a multi-week sell-off driven by investors’ anticipation of higher inflation and increased government spending linked to the trade and tax policies under US President Donald Trump.

Impact of MOF’s Bond Issuance Strategy on Global Markets

Japan’s decision to potentially curb the issuance of long-term government debt reflects the country’s strategic approach to managing its high public debt while attempting to support bond market stability. Ultra-long bonds typically have maturities extending several decades, and their supply can influence global yield curves due to Japan’s significant role as a creditor and investor.

The announcement was a critical signal to markets wary of tightening monetary conditions and inflationary pressures worldwide. Investors had been demanding higher yields in anticipation of US fiscal stimulus and protectionist trade measures, which historically increase inflation risk and government borrowing needs. This pressure triggered widespread bond sell-offs, raising yields and causing volatility in fixed income markets globally.

Japan’s MOF move effectively helped temper these dynamics by reducing supply pressure on long-duration bonds. The resulting rally in bond prices and yield decline alleviated concerns of spiraling borrowing costs, not only for Japan but also for other major economies sensitive to shifts in global capital flows. This intervention highlighted Japan’s unique position in global finance and demonstrated how coordinated fiscal signals can influence international investor behavior.

Key Facts

Japan’s MOF considers reducing issuance of ultra-long government bonds

Global Bond Markets: Prices rose, yields fell in Japan, South Korea, UK, and US

Bond Sell-Off Halted: Multi-week decline paused following MOF announcement

Investor Concerns: Rising inflation and US fiscal policy under President Trump

Ultra-Long Bonds: Long-maturity debt instruments with significant market impact

Global Impact: Demonstrates interconnectedness of sovereign debt markets

Market Reaction and Expert Commentary on Bond Yield Movements

The market response to Japan’s potential issuance cut was swift and notable. The Japanese government bond (JGB) market saw immediate price appreciation, with yields on long-dated maturities declining. Similarly, the US Treasury market (UST), UK Gilts, and South Korean bonds benefited from the risk-on sentiment.

Financial experts pointed out that Japan’s intervention temporarily mitigated the inflation-driven repricing that had unsettled fixed income investors. The move was perceived as a partial counterbalance to US President Donald Trump’s trade tariffs and tax reforms, which had created uncertainty about the future path of interest rates and fiscal deficits.

However, analysts caution that this is a short-term reprieve rather than a fundamental shift in global yield dynamics. Continued fiscal expansion and trade tensions could reintroduce volatility. The event underscores the delicate balance policymakers must maintain between debt management and market confidence in an era of geopolitical uncertainty.

Key Takeaways

Japan’s MOF announcement helped stabilize global bond yields amid inflation fears.

The move paused a multi-week bond sell-off triggered by US fiscal and trade policies.

Bond markets from Asia to Europe and North America reacted with price rallies and yield declines.

The intervention highlights Japan’s strategic role in global sovereign debt markets.

Analysts warn the reprieve may be temporary, with ongoing trade tensions posing risks.

Significance of Japan’s Bond Issuance Move for Global Financial Stability

Japan’s potential reduction in ultra-long bond issuance has momentarily calmed jittery global bond markets. By signaling a moderation in supply, the Ministry of Finance played a crucial role in counteracting inflationary and fiscal anxieties stemming from US policy shifts under President Trump.

This episode illustrates the sensitivity of global financial markets to sovereign debt management decisions by major economies and the interconnected nature of fixed income instruments worldwide. As geopolitical and economic uncertainties persist, such fiscal maneuvers will remain important tools to maintain market equilibrium and investor confidence.

Comments

This sale could signal a shift in how automation is prioritized across the tech sector

Forward-looking investments are fueling breakthroughs in automation and AI integration