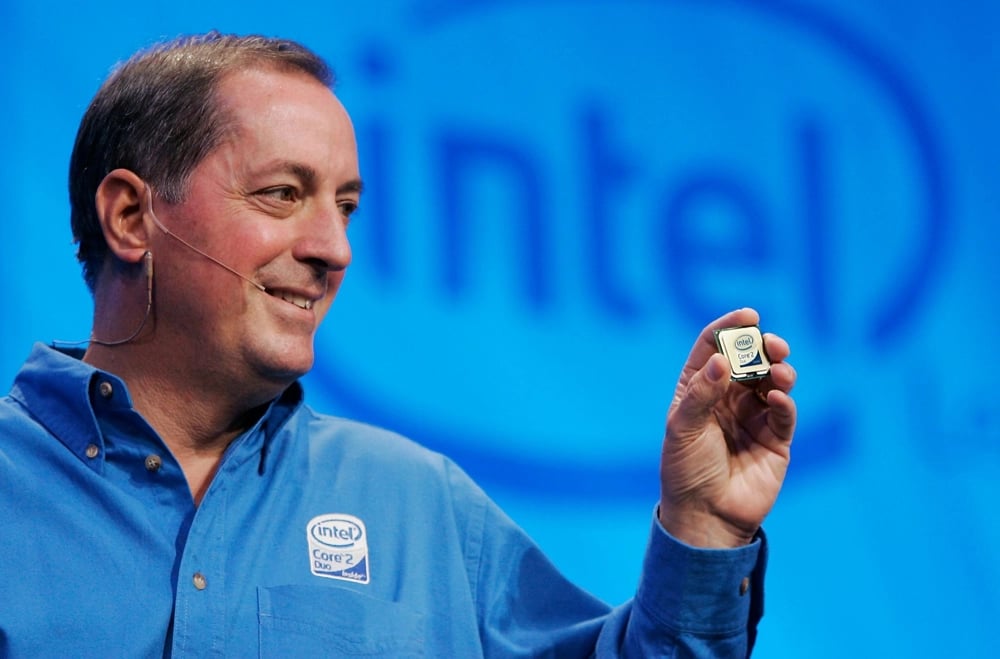

Intel Cuts Non-Core Assets: 51% of Altera Sold for $4.46 Billion

Intel Corporation continues its active efforts to reallocate resources and focus on its key business areas. On Monday, the company announced the sale of 51% of its programmable chip division, Altera, to private investment firm Silver Lake Management. The deal is valued at $4.46 billion, placing the full business valuation at $8.75 billion.

This move is part of a broader strategic reassessment of assets initiated by Intel's leadership in early 2024. The sale not only frees up capital from a less profitable segment but also signals a shift in the company’s investment priorities.

From Major Acquisition to Partial Divestiture

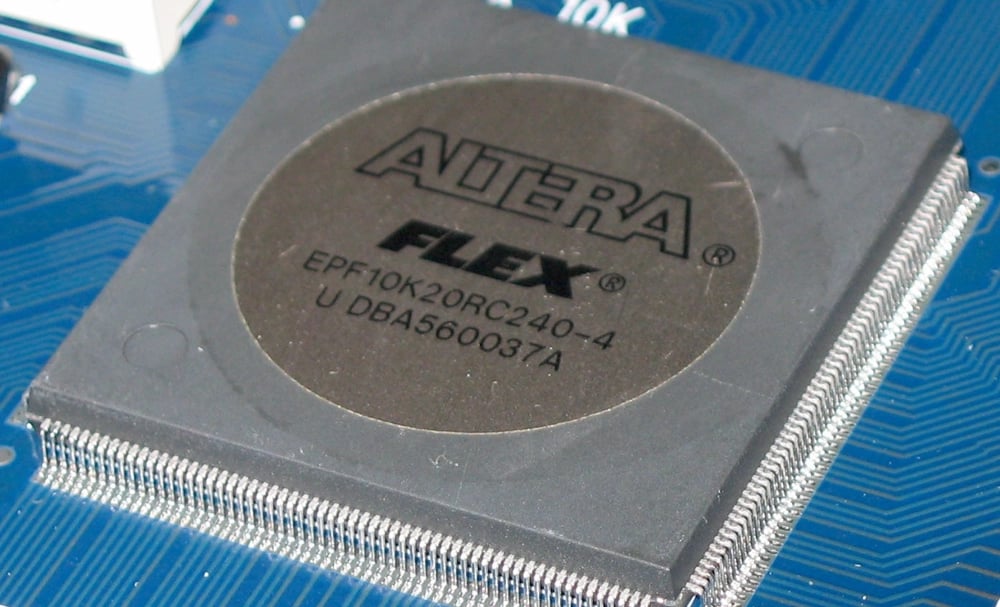

In 2015, Intel acquired Altera for $17 billion—one of the largest acquisitions in its history. Altera specializes in field-programmable gate arrays (FPGAs), widely used in telecommunications equipment, data centers, and other high-tech sectors.

The deal with Silver Lake cuts Altera's valuation nearly in half compared to the initial investment. However, Intel will retain a 49% stake in the division, maintaining a strategic foothold in the programmable chip market without bearing the full financial and operational burden.

Reasons Behind the Sale and Market Context

The transaction with Silver Lake reflects Intel’s new corporate philosophy focused on cost reduction and business prioritization. CEO Lip-Bu Tan noted that the decision demonstrates a commitment to «Focus attention, reduce structural expenses, and strengthen the balance sheet».

As part of its updated strategy, Intel aims to:

Divest non-core and capital-intensive assets

Reallocate investment to more promising and profitable areas

Reduce operating costs

Improve asset management flexibility

These efforts come amid intensifying competition in the semiconductor industry, especially in areas such as artificial intelligence, cloud infrastructure, and high-performance computing.

Interest from Other Players

Reports indicate that other companies also showed interest in acquiring Altera. Potential bidders included Lattice Semiconductor Corp and several investment firms. However, Silver Lake was ultimately selected, likely due to its strong track record in tech investments and its willingness to structure a deal that preserved Intel’s minority stake.

The presence of multiple interested parties underscores the ongoing relevance of Altera’s technologies, even amid a lower overall valuation. Intel’s choice suggests a preference for strategic partnership over full divestiture.

Leadership Changes at Altera

Alongside the announcement of the sale, Intel revealed leadership changes at Altera. As of May 5, 2025, Raghib Hussain will take over as CEO, replacing Sandra Rivera. The appointment signals a push to infuse Altera with new management direction as it enters a semi-autonomous phase backed by Silver Lake.

Hussain brings experience in corporate governance and technology leadership, making him a fitting choice to guide Altera through this transition.

Continuing the Restructuring Path

The partial sale of Altera is not an isolated move, but part of Intel’s broader strategy to transform into a leaner, more resilient company. Since early 2024, Intel has been reevaluating its portfolio to concentrate on:

Advanced processor manufacturing

Expansion of Intel Foundry Services

Data center technologies

Artificial intelligence infrastructure

The deal with Silver Lake may serve as a model for future transactions, allowing Intel to exit non-core businesses while preserving technological influence where relevant.

From Aggressive Expansion to Balanced Growth

For years, Intel pursued an aggressive expansion strategy through mergers and acquisitions. However, shifting market dynamics, rising development costs, and increasing competition have forced the company to rethink its approach.

Today, the focus is on deepening capabilities in core segments rather than expanding at any cost. The Altera sale clearly illustrates this shift—from vertical integration toward more flexible asset management.

Control Retained — Risk Reduced

By maintaining a 49% stake in Altera, Intel secures a position to benefit from any future growth of the asset without direct operational responsibility. This approach reduces risk while maintaining access to potentially strategic technologies.

Such a balance may prove to be the optimal compromise between capital discipline and long-term vision.

A New Chapter for Intel

The sale of a majority stake in Altera marks a new phase in Intel's evolution—from a diversified tech conglomerate to a focused technology holding. The company’s aim to streamline operations, rebalance spending, and focus on core products aligns with broader market trends and investor expectations.

While Intel relinquishes control over Altera, the deal opens the door to more efficient capital use. In an era of rapid technological change, such flexibility could become a key driver of competitiveness and growth.

Comments

This strategic move could redefine Intel's focus and spark innovation in its core businesses.

Intel's strategic move with Altera seems smart—let's see how it fuels future innovation!