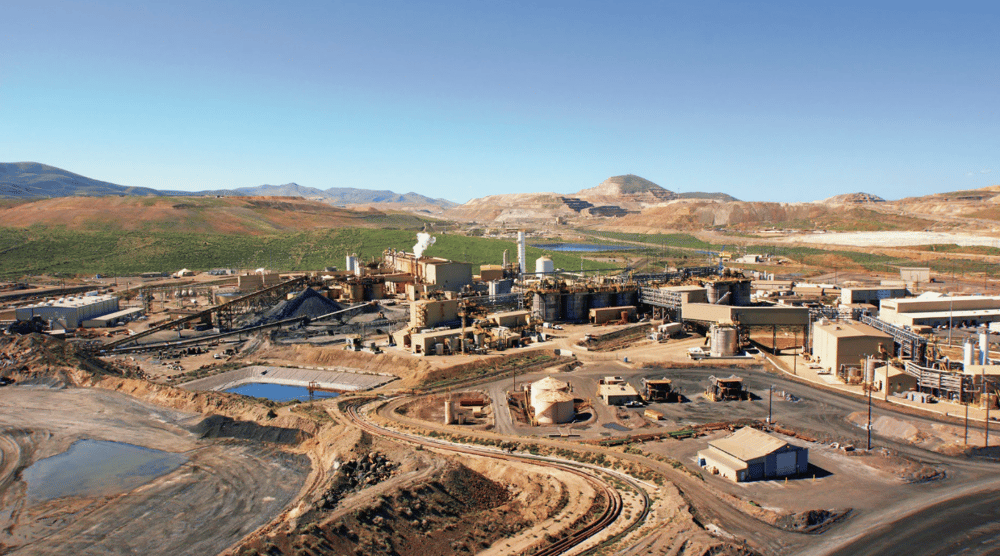

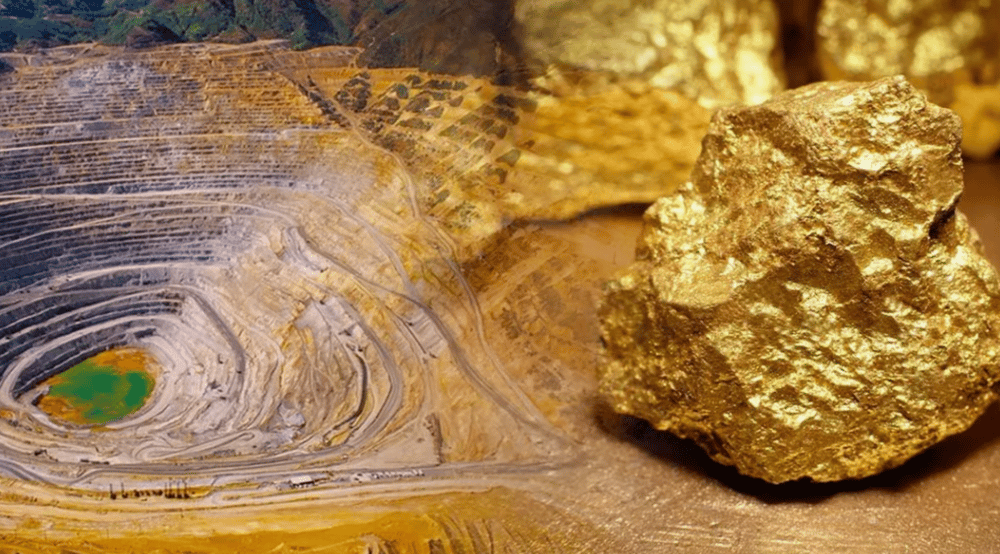

IFC Commits $700 Million to Pakistan’s Reko Diq Copper-Gold Mine

The International Finance Corporation (IFC), a member of the World Bank Group, has stepped up its financial support for Pakistan’s Reko Diq copper-gold mining project with an additional subordinated loan of $400 million. This commitment follows an earlier $300 million funding tranche announced in April, bringing IFC’s total financing to $700 million. The ambitious $6.6 billion project underscores the importance of international capital flows into resource infrastructure in emerging markets.

Financial Structuring and Strategic Implications of the IFC Loan

The Reko Diq mining project represents one of the largest copper and gold mining developments in Pakistan, requiring complex capital structuring to balance risk and return. IFC’s subordinated loan—characterized by its lower priority in repayment compared to senior debt—adds a critical layer of capital that enhances the project’s financial viability. The funding complements other debt and equity contributions from a consortium of lenders, collectively aiming to mobilize $6.6 billion in total project financing.

This financing arrangement not only mitigates risk for senior lenders but also signals IFC’s confidence in the long-term economic prospects of Pakistan’s mining sector. Subordinated loans typically carry higher interest rates due to increased risk but provide essential leverage for attracting additional private sector investment. By diversifying the funding mix, the project strengthens its capital base, ensuring smoother execution and scalability.

Key Facts:

IFC’s total financing for Reko Diq now totals $700 million

The new loan of $400 million is subordinated, enhancing capital structure

The overall estimated project cost stands at $6.6 billion

Funding involves a consortium mixing debt and equity instruments

The project aims to tap significant copper and gold reserves in Balochistan, Pakistan

Market Reaction and Stakeholder Perspectives

Market analysts view IFC’s bolstered commitment as a positive signal for Pakistan’s mining investment climate. The subordinated nature of the loan indicates a tailored approach to risk-sharing, which may encourage additional private and institutional investors to participate. The involvement of IFC also reassures stakeholders about governance standards, environmental considerations, and project transparency.

Industry experts highlight that such multi-layered financing is critical for large-scale infrastructure projects in developing countries, where political and operational risks are often elevated. The Reko Diq project’s progress could become a benchmark for future mining ventures across South Asia, influencing policy and attracting global capital.

Key Points:

IFC’s subordinated loan reduces financial risk for senior lenders

Total IFC funding of $700 million underscores strong institutional backing

The $6.6 billion cost requires a balanced mix of debt and equity

Project success may improve investor confidence in Pakistan’s extractive industries

Multi-source funding aligns with best practices in infrastructure financing

Strategic Importance and Outlook for Reko Diq and Pakistan’s Mining Sector

The International Finance Corporation’s expanded $700 million commitment through subordinated lending is a pivotal development for Pakistan’s Reko Diq copper-gold mine. By strengthening the project’s capital structure and reducing investment risk, IFC plays a crucial role in advancing one of the region’s most significant resource extraction initiatives. This move exemplifies how international finance institutions are increasingly supporting emerging market infrastructure, blending private and public capital to unlock economic potential.

The success of Reko Diq will likely encourage similar investments, further integrating Pakistan into global commodity markets and supporting sustainable economic growth through resource development.

Comments

Really inspiring to see bold financial moves driving new growth opportunities in emerging markets!