Huawei Boosts Semiconductor R&D with $25 Billion Annual Investment Amid U.S. Tech Gap

Huawei Technologies Co. Ltd., China’s flagship telecom and technology firm, has acknowledged that its chip manufacturing capabilities trail behind U.S. counterparts by roughly one generation. However, the company is aggressively ramping up investments in advanced semiconductor research. According to statements made by CEO Ren Zhengfei in an interview with People’s Daily, Huawei is leveraging cluster computing and composite chip design to bridge the technological divide. This marks a strategic pivot by the Shenzhen-based firm, which remains at the center of U.S.-China tech rivalry and export control tensions.

R&D Surge and the Shift Toward Complex, Multi-Element Chip Design

Huawei is now allocating 180 billion yuan (approximately $25.07 billion USD) annually to R&D efforts, a commitment that places it among the top global spenders in the semiconductor innovation race. This intensified focus comes as the company faces persistent challenges accessing advanced lithography tools and key technologies due to ongoing U.S. export restrictions.

Ren’s comments suggest that rather than attempting to compete head-to-head with industry leaders like NVIDIA $NVDA or Intel $INTC in terms of node parity, Huawei is choosing to compete through system architecture innovation. Cluster computing—an approach where multiple processors are networked together to function as a unified system—serves as a workaround to boost performance without relying on cutting-edge process nodes.

Moreover, Ren emphasized the role of compound semiconductors—chips created from multiple materials or integrated elements—as an emerging focus area. These chips are particularly useful in areas such as power electronics, high-frequency communications, and AI inference workloads, where traditional silicon-based approaches are reaching physical limitations.

Key Facts at a Glance

R&D Investment: ¥180 billion annually (~$25.07 billion USD)

Tech Gap: One generation behind U.S. semiconductor firms

Key Strategies: Cluster computing and compound chip design

Statement Source: People’s Daily, state-affiliated Chinese outlet

CEO: Ren Zhengfei

Target Sectors: AI, communications, and next-gen computing

Market Response and Broader Industry Commentary

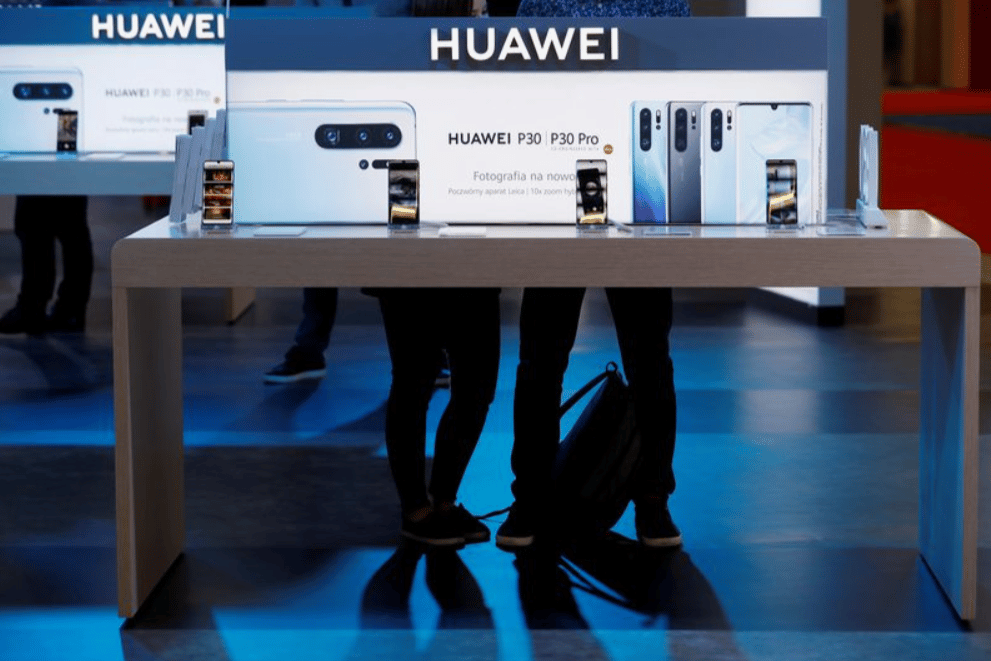

Huawei's strategic pivot has drawn mixed reactions across global tech markets. While some analysts question the feasibility of overcoming hardware restrictions through system-level workarounds, others view the company's R&D resilience as a credible long-term challenge to Western semiconductor dominance.

In geopolitical terms, this move reinforces China's strategic intent to achieve semiconductor self-sufficiency amid increasing decoupling from the U.S. supply chain. Huawei’s investment magnitude also sends a clear signal to domestic rivals and international observers: the company intends not just to survive but to shape the future of chip design with a distinctively Chinese technological path.

Investors have taken note, though Huawei remains privately held and its financial performance is not publicly traded. Nonetheless, shares of related Chinese chipmakers and research institutions have shown gains on domestic indices like the SSE Composite Index $000001.SS and the STAR Market.

Key Takeaways

$25 Billion R&D Commitment: Huawei positions itself as a top-tier global R&D spender in semiconductors.

Architectural Innovation: Focus on cluster computing reflects a non-traditional path to enhanced chip performance.

Compound Semiconductors: Emphasis on multi-element designs suggests diversification beyond silicon-based logic.

Strategic Autonomy: The initiative aligns with China’s broader drive for tech independence from the U.S.

Mixed Market Sentiment: While the move is technically ambitious, execution risks remain given global tech constraints.

Strategic Significance of Huawei’s Technological Repositioning

Huawei’s intensified R&D strategy signals a deliberate shift from conventional semiconductor competition to a differentiated, architecture-driven approach. By prioritizing cluster computing and composite chips, the company aims to maintain technological relevance and competitiveness, despite its generational lag. This development adds another layer to the complex landscape of global tech innovation, where resource allocation, national policy, and system-level creativity converge. While the long-term payoff remains uncertain, Huawei's roadmap reaffirms that leadership in the next wave of computing will not be dictated by process nodes alone.

Comments