Hilton Worldwide Holdings Inc. $HLT, one of the world’s largest hotel operators, has revised its forecast for revenue per available room (RevPAR) growth in 2025. The company cited weakening consumer travel spending as a key driver behind the downgrade, making it the first major U.S. hospitality brand to adjust guidance in response to macroeconomic fallout from escalating trade tensions.

The shift underscores growing concerns across the travel and leisure sectors, where persistent global uncertainty is beginning to weigh on demand for discretionary services such as vacation lodging and business travel.

Economic Headwinds Reach the Hospitality Industry

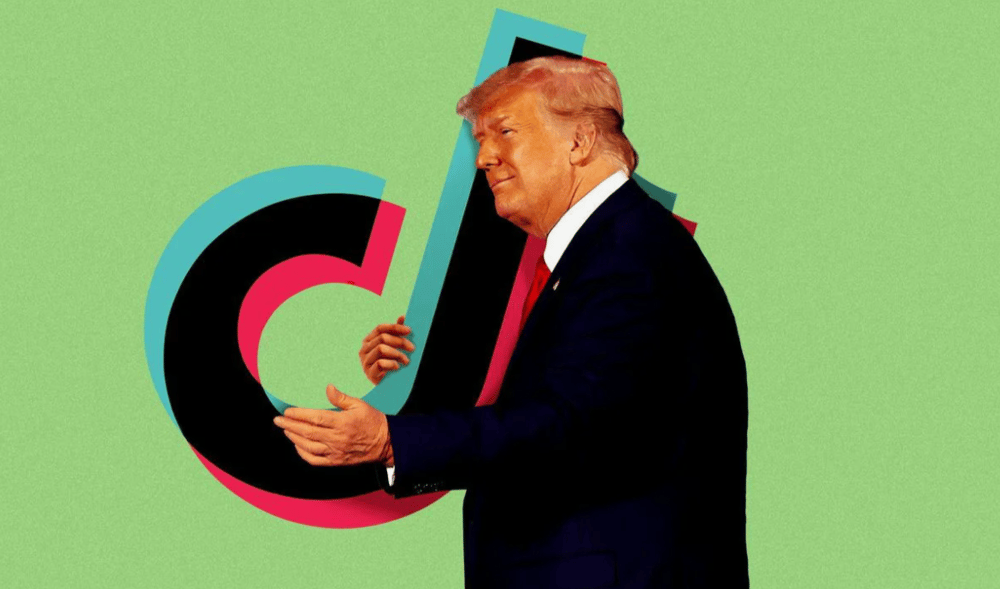

The decision by Hilton to revise its RevPAR growth expectations reflects an evolving economic landscape marked by inflationary pressures, shifting consumer priorities, and tariff-induced cost increases. The global trade conflict, initiated by broad tariff measures from former President Donald Trump, has introduced new volatility into consumer confidence and international travel patterns.

While travel demand showed resilience in the immediate post-pandemic recovery period, recent macroeconomic signals are prompting corporations and households to reevaluate discretionary budgets—including those for leisure and hospitality.

Underlying Forces Shaping the Forecast

Hilton’s reduced forecast is not a result of internal performance shortcomings, but rather a strategic recalibration amid emerging external risks. The company remains operationally strong, with robust occupancy rates and expansion plans across key growth markets. However, it is adopting a more conservative view of 2025 earnings potential based on the following dynamics.

Tariff-Driven Economic Uncertainty

Ongoing trade disputes have contributed to fears of a global slowdown, leading consumers to delay or scale back travel plans.

Cautious Consumer Spending

U.S. households, particularly middle-income travelers, are tightening budgets as inflation and tariffs erode disposable income.

International Travel Friction

Trade policies and visa restrictions are influencing cross-border travel, impacting international bookings.

Corporate Travel Constraints

Businesses are prioritizing cost efficiency, reducing non-essential travel, and exploring virtual alternatives.

Competitive Market Saturation

Intense competition within the hotel and short-term rental sectors is pressuring pricing power, especially in urban hubs.

Trends Worth Watching Across the Sector

As Hilton tempers expectations, industry peers are closely monitoring several trends that could influence broader hospitality forecasts:

Shift Toward Regional Travel: Short-haul and domestic travel may see a relative uptick as international trips decline.

Operational Efficiency Focus: Hotel chains are investing in automation and digitization to streamline costs.

Diversification of Revenue Streams: Operators are expanding into branded residences, vacation clubs, and wellness offerings to buffer volatility.

Sustainability Demands: Eco-conscious travelers continue to influence long-term infrastructure and investment decisions.

Labor Market Pressures: Staffing challenges remain, particularly in housekeeping and food service, impacting margins.

This strategic sale hints at a broader shift in how automation may evolve in tech