Gulf Air Resumes Bahrain–Kenya Route: Strategic Return Signals Gulf–Africa Aviation Expansion

After more than a decade, Gulf Air, Bahrain’s national airline, has resumed direct flights between Manama and Nairobi, marking a significant milestone in the evolving aviation and trade corridor between the Gulf Cooperation Council (GCC) and East Africa. The inaugural flight landed at Jomo Kenyatta International Airport (NBO) on June 2, 2025, marking Gulf Air’s return to the Kenyan capital after a 13-year absence.

This route revival reflects not only operational convenience but also a strategic recalibration of regional aviation routes that increasingly prioritize emerging African markets. The reintroduction of direct connectivity between Bahrain and Kenya is expected to stimulate trade, investment, tourism, and diplomatic relations.

Gulf Air’s Strategic Pivot: Regional Growth and Market Positioning

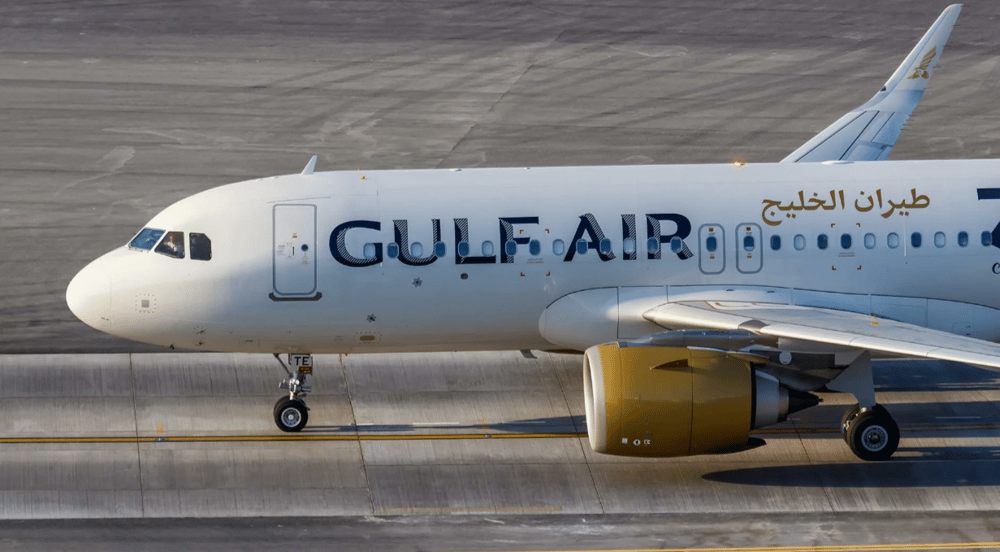

The launch of five weekly flights using Airbus A320neo aircraft is part of Gulf Air’s broader fleet optimization and route expansion strategy. The A320neo, known for its fuel efficiency and improved passenger experience, aligns with the airline’s goals of reducing operational costs while maintaining premium service quality.

Kenya, as East Africa’s commercial hub and a key player in the African Continental Free Trade Area (AfCFTA), presents a compelling market. The renewed route enhances Bahrain's access to the Sub-Saharan market, enabling deeper engagement across sectors such as infrastructure, energy, logistics, and tourism.

The Gulf region, particularly Bahrain and the UAE, has been increasing its investment footprint across Africa, with Nairobi positioned as a key gateway for East African trade. Gulf Air's return can thus be seen as both a symbol of restored connectivity and a functional bridge supporting cross-regional economic activity.

📌 Key Facts:

🛫 Flights resumed: June 2, 2025

🌍 Route: Bahrain (BAH) ↔ Nairobi (NBO)

✈️ Aircraft: Airbus A320neo

📅 Frequency: Five flights per week

📈 Objective: Strengthen bilateral trade, tourism, and aviation presence

Market Reactions and Strategic Implications

Industry analysts view Gulf Air’s return to Kenya as a calculated response to rising demand for intra-regional connectivity between the Middle East and Africa. The route is likely to support cargo movement, business travel, and diaspora mobility, as well as offer competitive alternatives to current carriers dominating the corridor, such as Emirates, Qatar Airways, and Turkish Airlines.

From a geopolitical standpoint, this move reinforces Bahrain’s intent to maintain a visible economic presence in Africa, positioning itself as an aviation and logistics intermediary. For Kenya, the return of Gulf Air increases airline diversity at NBO and improves inbound traffic from the Gulf, Europe, and Asia, thanks to Bahrain’s geographical positioning as a connecting hub.

The decision also aligns with Bahrain's Economic Vision 2030, which prioritizes diversification and global trade integration through sectors like transport, logistics, and tourism.

🔍 Key Points:

Strategic market re-entry targets underserved Gulf–East Africa corridor.

Fuel-efficient aircraft choice supports Gulf Air’s sustainability goals.

Enhanced trade and tourism potential benefits both Bahrain and Kenya.

Diversifies airline presence in East Africa, strengthening competitive dynamics.

Supports Bahrain’s geopolitical and economic outreach into Sub-Saharan Africa.

A Route Reborn with Strategic Ambitions

Gulf Air’s resumption of flights between Bahrain and Nairobi is more than a return to a dormant route; it is a forward-looking initiative that strengthens economic and diplomatic ties between the Gulf and Africa. With five weekly flights operated by next-generation aircraft, the carrier is strategically positioning itself in one of the world’s most dynamic aviation regions.

This move reinforces regional integration, responds to increasing demand for connectivity, and highlights the growing significance of Africa–GCC trade corridors in shaping future global air routes.

Comments