This sale stands as a catalyst poised to drive a paradigm shift in tech automation

Such bold actions signal a shift toward a more dynamic and forward-thinking approach in capitalizing on automation trends

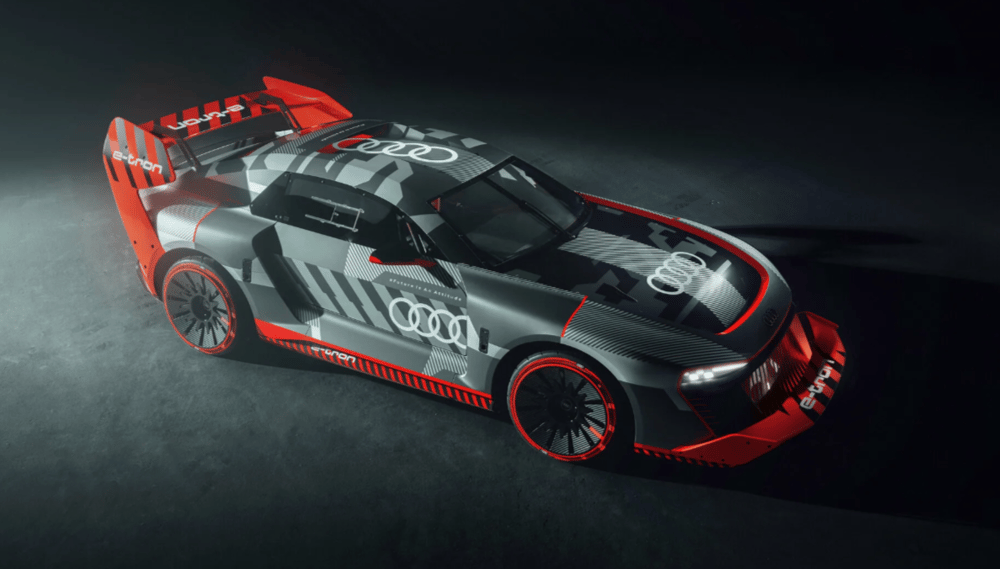

Audi, the premium brand under Volkswagen Group $VOW.DE , delivered robust first-quarter results for 2025, driven by a surge in electric vehicle (EV) sales. The German automaker reported a 12.4% increase in quarterly revenue, reaching €15.43 billion ($17.49 billion), up from €13.73 billion in the same period last year. These results underscore Audi's growing foothold in the premium EV market, which continues to gain traction across Europe and Asia.

Despite its strong start to the year, Audi maintained a cautious full-year forecast, citing that potential U.S. tariffs have not yet been factored into its guidance. The company expects full-year revenue between €67.5 billion and €72.5 billion, with an operating return of 7% to 9%, reflecting both confidence in its electrification strategy and awareness of rising geopolitical risks.

The acceleration in EV sales represents a strategic victory for Audi as it intensifies its transition away from internal combustion engines. With consumer adoption steadily rising and regulatory frameworks across the EU favoring clean mobility, Audi's performance aligns with broader industry trends. However, the company also acknowledges that macroeconomic pressures — particularly trade policy uncertainty — could dampen momentum later in the year.

Audi’s exposure to U.S. markets makes the potential imposition of tariffs a significant variable. As a premium automaker with global ambitions, the brand must continue to navigate trade frictions while scaling EV production and maintaining margin discipline.

Increased deliveries of electric models, particularly in the European market.

Favorable currency and pricing effects, boosting top-line figures.

Product mix optimization, emphasizing high-margin EVs and SUVs.

Stable demand across key regions, including China and Germany.

Ongoing cost discipline and efficiencies in production and logistics.

Audi’s performance in early 2025 offers a snapshot of a legacy automaker successfully adapting to a fast-evolving automotive landscape. Yet the company remains clear-eyed about the complexity of its operating environment. With tariffs not yet integrated into financial projections, Audi’s leadership signaled a commitment to agility and strategic hedging in case global trade dynamics shift.

The automaker is also investing heavily in platform-sharing efficiencies within the Volkswagen Group, advancing both software development and battery technology integration. These initiatives are aimed at scaling EV volume while preserving premium brand identity and profitability.

Expand EV portfolio, with a focus on luxury crossovers and sedans.

Reinforce profitability through supply chain integration and cost optimization.

Monitor tariff developments, particularly U.S.–EU trade relations.

Leverage VW Group synergies, especially in technology and manufacturing.

Maintain balance between ICE, hybrid, and EV offerings to meet varied regional demand.

Audi’s first-quarter performance reflects the brand’s ability to capture demand in the evolving premium EV segment, while demonstrating operational resilience. The company’s cautious full-year outlook — despite strong early figures — highlights a strategic awareness of external volatility, especially in trade relations with the United States.

As Audi navigates the remainder of 2025, its success will depend not only on maintaining EV sales momentum but also on adapting quickly to policy shifts and consumer behavior changes. In an industry where agility increasingly defines competitive advantage, Audi appears well-positioned — but remains vigilant.