CommScope Weighs $10 Billion Sale of CCS Division Amid Ongoing Debt Reduction Strategy

CommScope Holding Co. $COMM is reportedly exploring a sale of its Connectivity and Cable Solutions (CCS) business unit, potentially valuing the division at up to $10 billion. This move marks another significant chapter in the company’s multi-year effort to deleverage its balance sheet and refocus on core operations.

The news highlights CommScope’s continued pivot following economic disruptions during the COVID-19 pandemic and a series of high-cost acquisitions that substantially increased its debt burden. Sources familiar with the matter revealed that the company has engaged both industry players and private equity firms to gauge interest in the asset.

A Complex Landscape of Strategic Realignment

CommScope’s decision to explore a divestiture of one of its key business lines aligns with its broader restructuring roadmap. Over the past year, the company has made notable moves to rebalance its portfolio, including the $2.1 billion sale of its outdoor wireless network and distributed antenna systems unit to Amphenol $APH in a bid to strengthen its financial foundation.

While no final decision has been made, CommScope is working with financial advisers to evaluate potential offers and structure the transaction.

Driving Factors Behind the Potential Sale

Debt Mitigation Efforts The CCS sale is expected to contribute significantly to CommScope’s ongoing deleveraging campaign following pandemic-related setbacks.

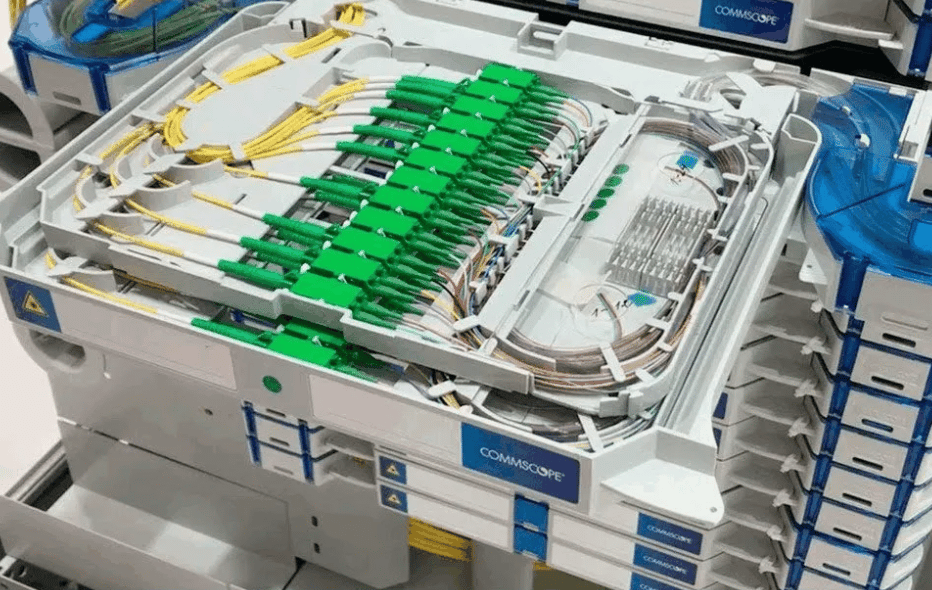

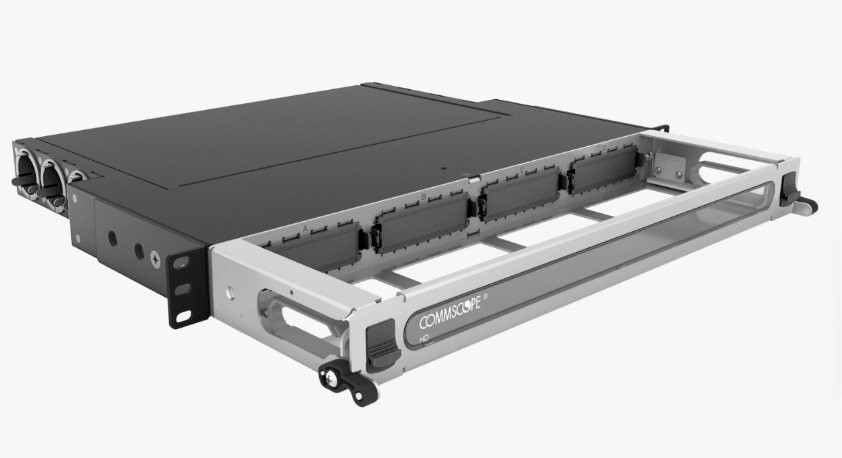

Attractiveness of CCS Assets The division's robust broadband infrastructure offerings have strong market appeal amid rising global demand for fiber and connectivity upgrades.

Strategic Refocus By narrowing its operational focus, CommScope may better align its resources with high-margin, growth-oriented business units.

Private Equity Involvement CommScope’s outreach to investment firms indicates appetite for infrastructure assets with recurring revenue profiles.

Market Conditions Elevated interest in network infrastructure, spurred by digital transformation and public investment, provides a timely exit opportunity.

Recent Moves Indicating Broader Transformation

Divested outdoor wireless assets to Amphenol for $2.1 billion

Shifted focus from hardware-heavy segments to higher-efficiency, software-enabled solutions

Continued exploration of capital structure enhancements and business simplification

Factors Making CCS an Appealing Asset

Expanding Fiber Rollouts: With governments and telecom providers ramping up broadband initiatives, CCS’s product lines are strategically positioned.

Recurring Client Base: A long-standing client roster offers revenue stability and predictable cash flows.

Cross-sector Applications: The unit’s solutions span telecommunications, enterprise networking, and smart cities, diversifying end-market exposure.

Global Footprint: CCS holds meaningful presence in key international markets, enhancing buyer appeal.

Strategic Levers Companies Are Evaluating

1. Asset Monetization Potential CCS represents one of CommScope’s most valuable holdings and is central to its restructuring playbook.

2. Stakeholder Sentiment Equity markets typically respond favorably to clear deleveraging strategies, especially those involving high-value asset sales.

3. Operational Synergies Prospective buyers may view CCS as a bolt-on acquisition to expand vertically or geographically.

4. Long-Term Scalability As digital infrastructure demands surge, scalable businesses like CCS remain in high demand.

5. Regulatory Landscape Any deal would be closely scrutinized for competitive and compliance implications, particularly in global markets.

Looking Ahead: Reshaping the Telecom Infrastructure Map

If CommScope proceeds with the divestiture of CCS, it would mark a significant reshuffling within the broadband infrastructure space. The move signals both a strategic refocus and a pragmatic approach to debt management in a volatile macroeconomic climate. Amid surging demand for fiber connectivity and data-driven applications, this transaction could open new competitive dynamics in the global telecom supply chain.

By shedding one of its cornerstone assets, CommScope underscores a trend already visible across the sector: streamlined operations, asset-light models, and a relentless push for capital efficiency in an increasingly interconnected world.

Comments