Coinbase Strengthens Political Reach as Kamala Harris Advisor David Plouffe Joins Advisory Board

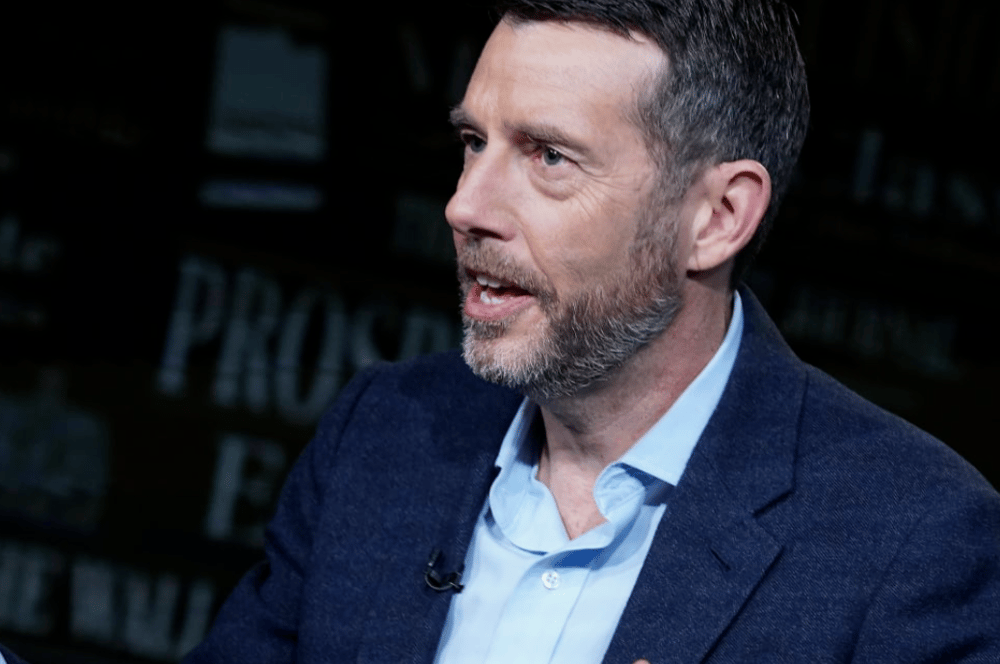

Coinbase $COIN, one of the world’s leading cryptocurrency exchanges, continues its expansion into the political arena by welcoming David Plouffe, former senior advisor to Kamala Harris’s 2024 presidential campaign, to its Global Advisory Council. This strategic move comes as U.S. lawmakers face mounting pressure to establish a regulatory framework for digital assets amid growing institutional adoption.

Plouffe, a veteran Democratic strategist best known for masterminding Barack Obama’s 2008 presidential victory, adds considerable political weight to a board already featuring former U.S. senators and Trump’s ex-campaign manager. His appointment underscores how cryptocurrency platforms are bolstering their lobbying efforts in Washington to influence evolving legislation.

Strategic Alliances: Crypto and Political Powerbrokers

The inclusion of prominent political figures in Coinbase’s advisory infrastructure signals a deepening alliance between the crypto sector and Washington. Amid calls for regulatory clarity, crypto firms are increasingly seeking counsel from individuals with insider knowledge of the U.S. legislative process.

Coinbase's advisory board already includes former Senators Patrick Toomey (R) and Heidi Heitkamp (D), as well as Trump’s 2020 campaign manager, Brad Parscale. Plouffe’s background in political strategy and public affairs further enhances the exchange's ability to navigate bipartisan complexities.

These appointments are timely. In the wake of market volatility and enforcement actions against crypto firms, regulatory reform has taken center stage in congressional debates. Industry leaders are investing in policy expertise to safeguard innovation while complying with shifting legal standards.

Key Developments at a Glance

📌 David Plouffe, Obama campaign architect, joins Coinbase Advisory Board

📌 Advisory board includes bipartisan political veterans

📌 Expansion coincides with growing legislative focus on digital assets

📌 Coinbase increases Washington engagement amid regulatory uncertainty

📌 Strategic push to influence crypto regulatory frameworks

Market Reaction and Broader Implications

Though Plouffe’s addition is a political rather than financial maneuver, it sends a strong signal to markets about Coinbase’s strategic direction. It suggests the exchange is not merely reacting to regulatory threats but proactively shaping policy outcomes.

The broader crypto market (BTC, ETH) has remained stable following the news, but industry stakeholders view the development as part of a longer-term trend: institutionalization of crypto through regulatory integration.

Plouffe's experience in shaping national campaigns and advising senior policymakers could translate into tangible influence in how Congress drafts crypto-related legislation. His network within Democratic circles may also help Coinbase bridge gaps with traditionally crypto-skeptical lawmakers.

Strategic Implications

Bipartisan Appeal – Coinbase builds cross-party influence with advisors from both major U.S. political parties.

Regulatory Navigation – Plouffe’s insights may help Coinbase engage with the SEC and CFTC more effectively.

Policy Anticipation – Advisory input may inform Coinbase’s product decisions and compliance infrastructure.

Reputational Strengthening – Demonstrates institutional maturity to investors and regulators.

Industry Influence – Coinbase continues positioning itself as the crypto industry's political vanguard.

Coinbase as a Policy Architect in the Crypto Era

David Plouffe’s appointment to the Coinbase Global Advisory Council marks a significant evolution in how crypto exchanges interact with political institutions. Far from being a peripheral player, Coinbase is actively engineering its role in shaping U.S. crypto policy.

As legislation advances, the fusion of political experience and financial innovation will likely define the next chapter in the crypto market’s evolution. With strategic hires like Plouffe, Coinbase is not merely lobbying—it’s legislating from the boardroom.

Comments

Transformational moves like this reshape not just companies but entire industry landscapes

I'm intrigued to see if merging political insight with crypto innovation could pave the way for smarter regulation.