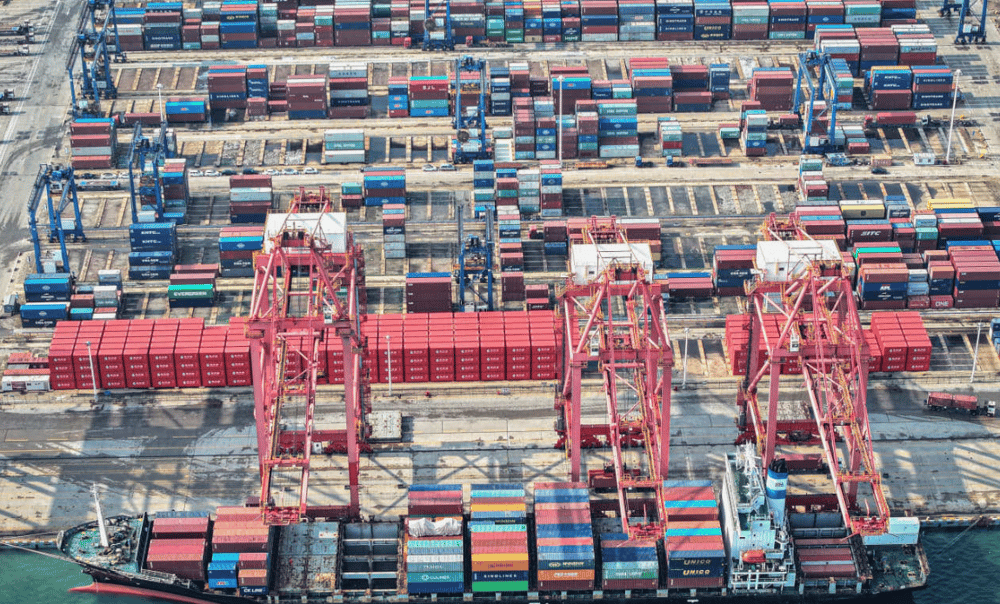

China Export Growth Hits Three-Month Low as U.S. Tariffs Tighten, Industrial Deflation Deepens

China’s export performance in May 2025 underscored mounting economic challenges, as trade tensions with the United States intensified and producer prices fell sharply. Official customs data revealed a marked slowdown in overseas shipments, dragging growth to its weakest pace in three months. The dual pressure of waning foreign demand and deepening deflation in the manufacturing sector is straining the world’s second-largest economy both externally and domestically.

Trade Tensions and Deflation Erode China’s Economic Momentum

Fresh customs data show that China’s exports to the U.S. plunged by 34.5% year-over-year in May — the steepest decline since February 2020, when the COVID-19 pandemic froze global commerce. This sharp contraction reflects the direct impact of renewed U.S. tariffs, reignited under ongoing trade war dynamics, echoing policies first initiated during Donald Trump's presidency.

China’s broader export growth also lost steam, weighed down by declining orders in the Pacific Rim and weakening global demand for industrial goods. At the same time, producer prices in China registered their most severe year-on-year deflation in over two years, with the Producer Price Index (PPI) falling 4.1% in May. Persistent factory-gate price declines are undermining corporate margins and discouraging capital expenditure, indicating structural softness in the industrial sector.

Key Export and Economic Indicators:

China–U.S. exports (May 2025): ▼ 34.5% YoY

Overall export growth (China, May 2025): +0.8% YoY (lowest since Feb 2025)

PPI (Producer Price Index): ▼ 4.1% YoY

U.S. tariffs impact: Intensified supply-chain friction across electronics, textiles, and machinery

Global demand: Softening amid macroeconomic tightening in Western markets

Market Reactions and Commentary

Global markets responded with cautious sentiment as the trade data signaled deteriorating prospects for Chinese industrial output. The Shanghai Composite Index $000001.SS edged down 1.2% following the release, while the Hong Kong Hang Seng Index $^HSI slipped 1.8%, driven by declines in export-heavy sectors.

In the currency markets, the Chinese yuan (CNY) weakened slightly against the U.S. dollar (USD), reflecting investor concerns over China’s economic resilience. Analysts suggest that continued deflation in the producer segment may force policymakers to introduce additional fiscal or monetary stimulus, though the effectiveness of such measures remains in question given external headwinds.

Market and Economic Takeaways:

Tariff Burden Deepens: U.S. tariff extensions reduced China's trade competitiveness in key sectors.

Export Partners Affected: Pacific trade allies reliant on Chinese intermediates are seeing cascading disruptions.

Currency Volatility: Pressure on the yuan reflects broader concerns over capital flows and investment sentiment.

Industrial Deflation Risks: PPI contraction points to excess capacity and eroded profit margins across manufacturing.

Policy Dilemma: China’s leadership faces the challenge of balancing domestic stimulus with global demand constraints.

A Compounded Strain on China’s Economic Engine

The sharp contraction in exports to the U.S. and deepening industrial deflation illustrate the complex web of challenges facing the Chinese economy. With global demand softening and trade tensions reigniting, China’s role as a global manufacturing powerhouse is being tested. The path forward may require structural policy responses, re-evaluation of trade strategies, and greater diversification of export markets.

Given the scale of the export decline and the persistence of deflationary trends, these developments are not isolated data points — they reflect an inflection in the trajectory of China’s post-pandemic recovery. The long-term implications for global supply chains and trade relations remain profound.

Comments