Chart Industries and Flowserve Corp Announce a $ 19 Billion stock Merger amid Growing Demand

Chart Industries $GTLS and Flowserve Corp $FLS have agreed to merge in a stock-for-stock transaction that values the combined enterprise at approximately $19 billion. This consolidation emerges against the backdrop of expanding global investments in artificial intelligence (AI) and the rapid growth of modern data centers, both driving unprecedented demand for advanced industrial equipment and post-sale services.

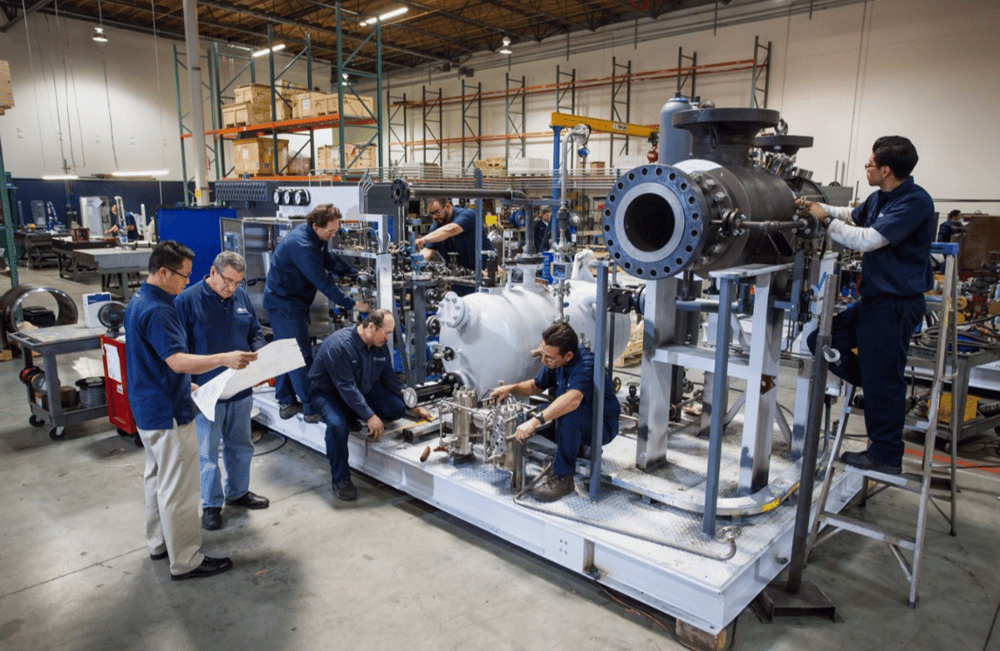

The merger is designed to integrate Chart’s expertise in cryogenic and industrial gas equipment with Flowserve’s leadership in flow management systems, aiming to capture the growing market for sophisticated cooling solutions essential for powering AI servers and data processing infrastructure.

Deal Structure and Industry Implications

The $19 billion stock-for-stock deal signifies a significant consolidation within the industrial equipment sector. By combining their complementary technologies and market reach, Chart Industries and Flowserve are poised to enhance operational synergies and scale up their offerings to meet rising customer demands.

Chart Industries specializes in the production of cryogenic equipment and fluid management solutions crucial for liquefied gases, while Flowserve Corp provides engineered flow control systems widely used in energy, chemical, and infrastructure sectors. Together, the merged entity is expected to broaden its product portfolio and strengthen its after-sales services division, creating new revenue streams.

Key drivers behind this merger include the surge in AI applications that require high-efficiency cooling to maintain server performance and reliability. Data centers, now central to AI operations worldwide, depend heavily on advanced liquid cooling systems to handle intense computational loads and energy consumption.

The merger also reflects the increasing importance of post-sale services in the industrial equipment market. Service contracts, maintenance, and technical support are becoming crucial revenue contributors as customers seek to maximize uptime and equipment longevity.

Brief Facts

Chart Industries and Flowserve Corp agreed to merge in a stock-for-stock deal.

Combined company valuation approximated at $19 billion.

The merger targets the growing industrial equipment market fueled by AI and data center demands.

Chart Industries specializes in cryogenic and liquefied gas equipment.

Flowserve is a leader in engineered flow control systems.

Emphasis on advanced cooling and liquid cooling technologies for servers and data centers.

Enhanced focus on post-sale services, including maintenance and support.

Market Reaction and Industry Commentary

The market responded positively to the announcement, with investors anticipating strengthened competitive positioning for the merged entity. Analysts highlight that combining Chart’s and Flowserve’s technology portfolios allows for a broader range of solutions tailored to emerging sectors like AI data centers, which require cutting-edge cooling infrastructure.

Industry experts note that this merger could accelerate innovation in liquid cooling technologies, which are essential for mitigating heat in high-performance computing environments. Additionally, by expanding their after-market services, the company can secure steady revenue streams and deepen customer relationships.

Financial markets have also taken note of the synergy potential, forecasting cost savings from streamlined operations and joint procurement. The stock-for-stock nature of the deal signals confidence from both companies in the long-term growth outlook of industrial equipment linked to technology infrastructure.

Key Points

Chart Industries and Flowserve to merge, creating a $19 billion industrial equipment powerhouse.

The merger is a strategic response to surging AI and data center demands for cooling solutions.

Combined expertise spans cryogenics, liquefied gas equipment, and engineered flow control systems.

Emphasis on post-sale services growth as a critical revenue driver.

Market views the merger positively, anticipating operational synergies and enhanced innovation.

Stock-for-stock transaction reflects mutual confidence and alignment of growth strategies.

Expected to improve competitive positioning in industrial equipment and data center markets.

Significance of Chart Industries and Flowserve Merger for Industrial Equipment Markets

The Chart Industries and Flowserve merger represents a landmark transaction in the industrial equipment sector, driven by transformative shifts in AI technology adoption and data center expansion. By uniting their technological strengths and service capabilities, the combined company is well-positioned to capitalize on accelerating demand for advanced cooling and flow management solutions.

This merger underscores the evolving industrial landscape, where innovation and comprehensive service offerings are paramount to meet the needs of rapidly growing technology infrastructure sectors. The $19 billion valuation reflects investor confidence in the merged entity’s potential to deliver long-term growth, operational efficiency, and sustained market leadership.

Comments

Forward-looking investments are accelerating growth in automation and AI applications

Major transactions like this highlight growing confidence in automation-led innovation