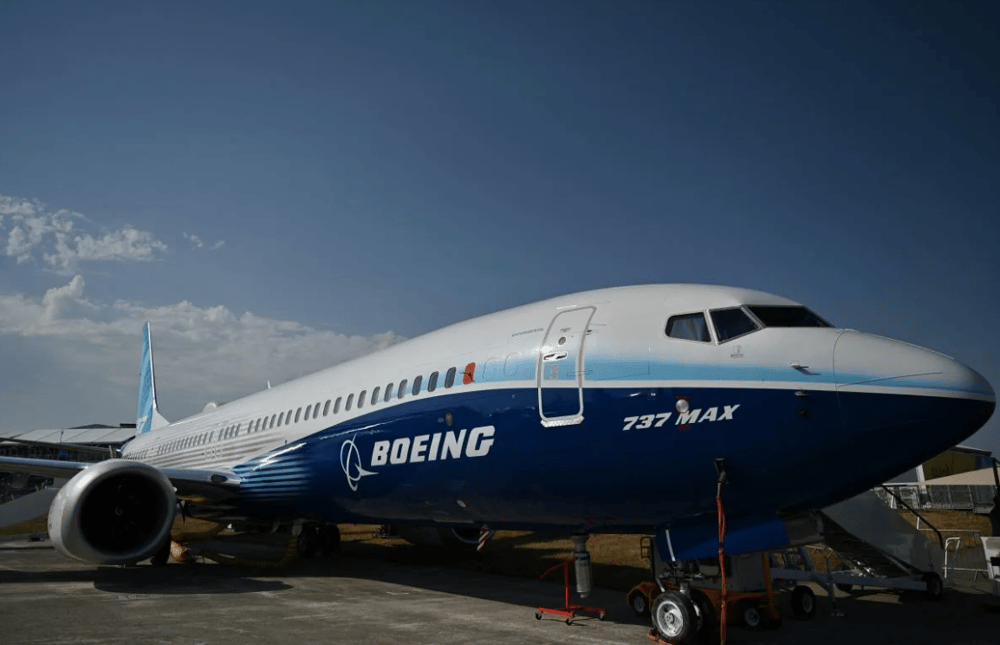

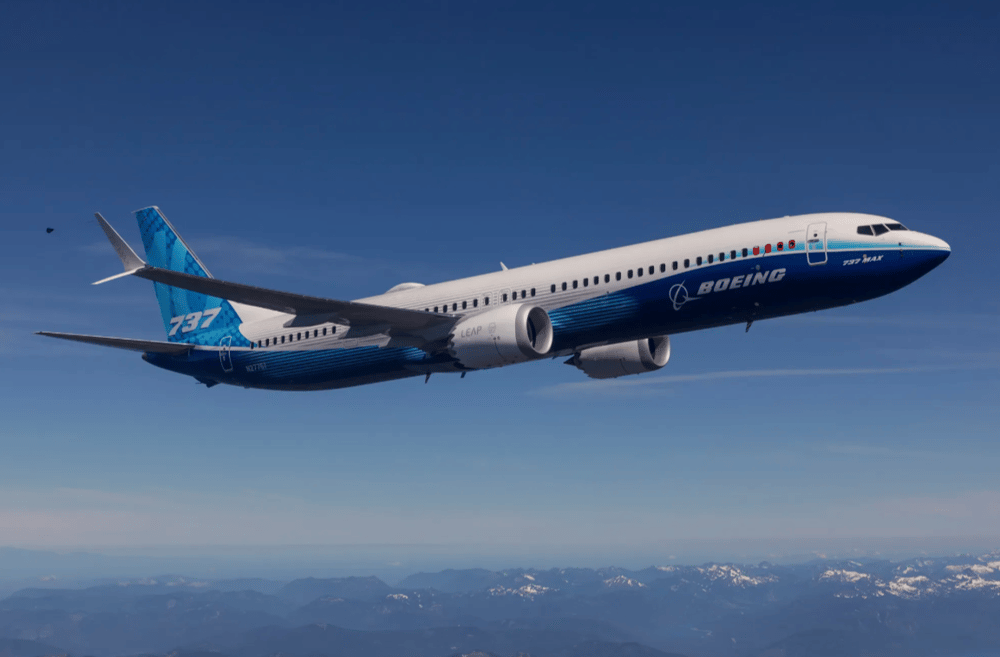

Boeing Soars into Paris Air Show with Record Orders and Boosted 737 MAX Output

Boeing $BA enters the Paris Air Show with renewed confidence following an exceptionally strong May performance. The U.S. aerospace giant reported 303 new aircraft orders and a delivery of 45 planes last month, reaffirming its production recovery trajectory amid a gradually improving global aviation market.

Significantly, Boeing confirmed it rolled out 38 737 MAX aircraft in May — the company's most crucial narrow-body jet — a rate it had targeted for over a year amid persistent supply chain constraints and regulatory scrutiny. The surge in both orders and deliveries underscores stabilizing demand from global carriers and signals Boeing's renewed competitiveness in the face of ongoing challenges.

Boeing's Historic Order Surge: Analysis and Implications

May’s order book marked the sixth-highest monthly total in Boeing’s history, driven by robust demand for both narrow-body and widebody aircraft. The headline order came from Qatar Airways, which signed the largest widebody aircraft deal in Boeing’s history: 130 787 Dreamliners and 30 777X jets, with options for an additional 50 long-haul aircraft.

This agreement not only highlights strong recovery in long-haul demand but also solidifies Boeing’s strategic position in the widebody segment — a key revenue contributor. Widebody aircraft typically command higher margins and are essential to Boeing’s profitability, especially in contrast to the more volatile narrow-body market.

📌 Key Facts:

✈️ 303 aircraft orders in May — sixth-largest monthly total in Boeing’s history

🔧 38 Boeing 737 MAX jets produced — the company's highest monthly output since early 2023

📦 45 total aircraft delivered across commercial models

🤝 Qatar Airways' record-breaking order: 130 787s, 30 777X, plus 50 optional

🛫 Surge driven by rebound in long-haul air travel and fleet modernization

Market Reactions and Industry Commentary

Investors responded favorably to the news, with Boeing’s share price gaining momentum in early June trading. The order strength and improved production cadence provide much-needed reassurance following a turbulent few years marked by regulatory investigations, supply disruptions, and pandemic-related headwinds.

Industry analysts noted that while Airbus $AIR.PA continues to lead in overall order volume, Boeing’s resurgence in the widebody market could help narrow the gap in 2025 and beyond. Qatar Airways’ order also reflects growing confidence among global airlines in Boeing’s ability to deliver on complex, high-value projects.

Additionally, reaching the 38-unit monthly production milestone for the 737 MAX signifies progress in stabilizing its narrow-body supply chain — a crucial factor in meeting rising demand from budget and regional carriers worldwide.

📌 Key Takeaways:

Boeing’s May order surge reflects renewed demand for both widebody and narrow-body jets.

Qatar Airways’ record deal strengthens Boeing’s position in the long-haul segment.

737 MAX output milestone signals progress in operational recovery.

Market confidence is returning, with positive signals for both investors and airline customers.

Competitive dynamics between Boeing and Airbus may shift as widebody demand rebounds.

A Turning Point for Boeing’s Recovery Strategy

Boeing’s May performance serves as a strategic inflection point, marking not only a strong commercial comeback but also a vote of confidence from major global carriers. As the aerospace sector prepares for one of its most closely watched events — the Paris Air Show 2025 — Boeing arrives with a stronger order book, improving production discipline, and growing momentum in both narrow-body and widebody markets.

With global air travel continuing its post-pandemic normalization and airlines aggressively renewing fleets to meet emission standards and operational efficiency targets, Boeing’s ability to execute consistently will be central to maintaining its upward trajectory.

Comments