Boeing Gains Altitude as China Lifts Import Ban Following Tariff Truce

A significant breakthrough in U.S.–China trade relations has created fresh momentum for Boeing Co. $BA, as Beijing reportedly lifted an informal ban on American-made aircraft deliveries. According to sources cited by Bloomberg on Tuesday, Chinese officials have begun informing state-owned carriers and government bodies that imports of Boeing planes can resume. This development follows a mutual agreement between Washington and Beijing to temporarily ease high tariffs—a move that has sent ripples through the aerospace and broader manufacturing sectors.

The policy reversal represents more than just a regulatory shift. It suggests a renewed appetite for bilateral engagement in high-stakes industries, particularly aviation, where Boeing has historically played a pivotal role in Chinese fleet modernization.

Reopened Skies and Renewed Demand

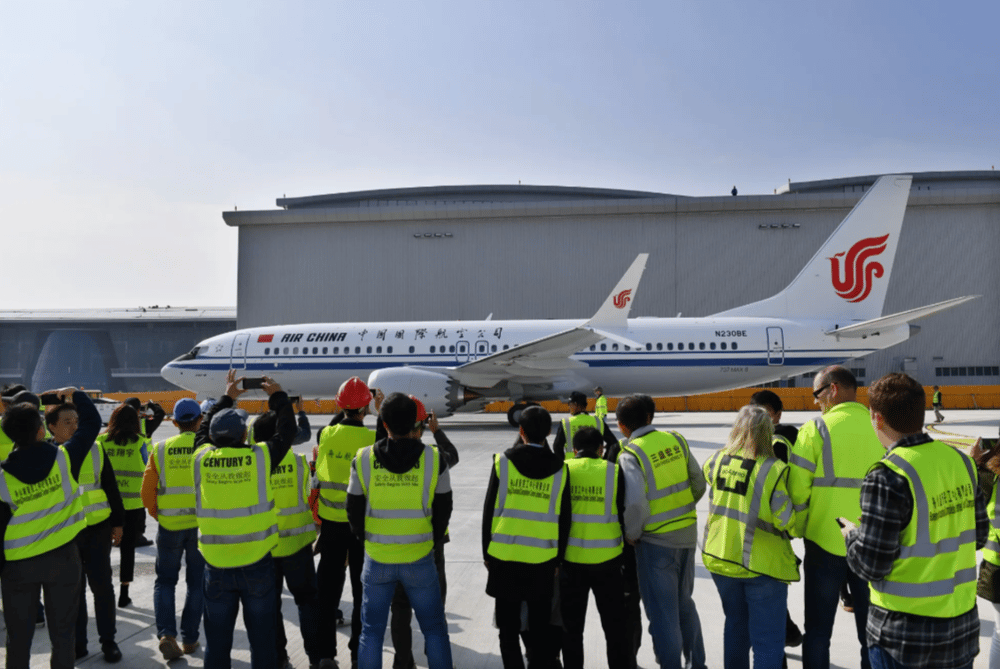

China had effectively frozen deliveries of Boeing aircraft for several years, largely due to escalating trade tensions and national security concerns. In April, at least three aircraft stationed at Boeing's delivery center in China were redirected back to the United States, underscoring the depth of the impasse. At the time, Boeing was preparing to remarket dozens of planes originally destined for Chinese carriers.

The new developments mark a sharp departure from that trajectory. With tariffs now moderated and formal restrictions eased, Chinese airlines may resume long-delayed fleet expansions—benefiting both domestic aviation and the American aerospace giant. The timing is critical: China’s post-pandemic rebound in air travel and plans to upgrade its aging fleet align perfectly with Boeing’s delivery pipeline.

Companies and Sectors Set to Feel the Ripple Effect

Boeing Co.: The most direct beneficiary, Boeing stands to unlock significant deferred revenue and offload inventory built for Chinese clients.

Chinese State-Owned Airlines: Carriers such as Air China, China Southern Airlines, and China Eastern Airlines may accelerate procurement of wide-body aircraft.

Aerospace Suppliers: U.S. firms like Spirit AeroSystems Holdings Inc. $SPR and Honeywell International Inc. $HON could benefit from a resurgence in Boeing’s production activity.

Logistics and Maintenance Firms: Companies supporting global aircraft delivery and servicing may see increased demand.

Commodities and Components: The renewed aircraft pipeline may revive demand for key materials such as aluminum and titanium, boosting sectors tied to aviation-grade manufacturing.

Strategic Considerations and Industry Responses

Though the decision offers welcome news for Boeing and its supply chain, several layers of complexity still surround the resumption of deliveries. Analysts and market participants are watching closely as developments unfold in real-time.

Fleet Modernization Timelines Chinese carriers will need to reassess delivery priorities and route optimization strategies as they reintegrate Boeing aircraft into their procurement plans.

Geopolitical Risk Assessment This trade thaw is viewed as temporary by many observers. Future tensions could once again interrupt the commercial flow of aircraft.

Inventory Management and Resale Strategy Boeing’s backlog for China-bound jets was at risk of being remarketed globally. Adjusting these plans will take logistical and contractual coordination.

Regulatory Hurdles and Safety Certification Despite improved trade sentiment, aircraft deliveries must still clear domestic regulatory standards in China—potentially delaying short-term gains.

Competitor Dynamics The return of Boeing to the Chinese market will likely influence Airbus SE $AIR.PA, which gained market share during the U.S. export freeze.

Navigating a Fragile Recovery in Aerospace Trade

The unfreezing of aircraft deliveries marks a potential inflection point for Boeing and the broader aviation supply ecosystem. While optimism is warranted, especially for stakeholders who have long absorbed the impact of trade disruptions, caution persists. The temporary nature of the tariff relaxation means any long-term gains depend on the durability of U.S.–China cooperation and macroeconomic alignment.

Still, for an industry that thrives on multi-year planning and logistical precision, this development offers a much-needed window of opportunity to reestablish momentum—and possibly rebuild a cornerstone of global aerospace trade.

Comments

The implications of this sale for automation could be far-reaching in the tech sector.