Biden Blocks Nippon Steel’s $14.9B Acquisition of U.S. Steel, Sparking Economic and Political Tensions

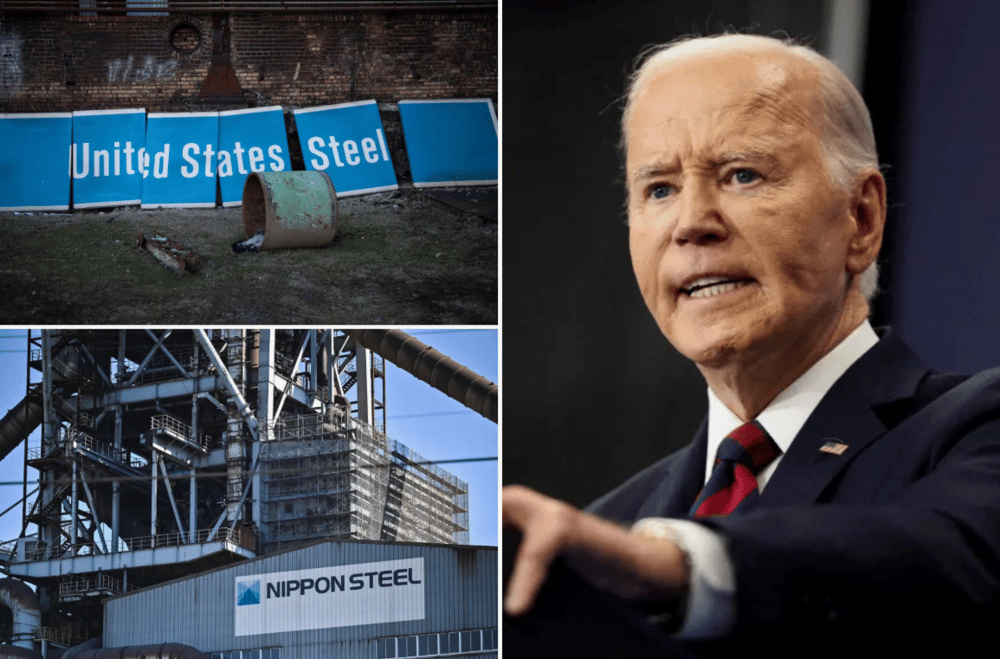

In early January, under snowfall in suburban Pittsburgh, Nippon Steel $5401.T Executive Vice President Takahiro Mori convened with local stakeholders to assure them of the company’s long-term commitment to the region. The Japanese steelmaker had recently proposed a $14.9 billion takeover of U.S. Steel $X, one of America's oldest industrial giants. However, U.S. President Joe Biden intervened, blocking the cross-border acquisition — citing national interests and the protection of American jobs.

This dramatic move has turned what seemed to be a straightforward corporate transaction into a broader geopolitical and economic issue. It raised critical questions around foreign investment, domestic labor markets, and the future of the U.S. steel industry.

Core Analysis — Strategic Interests and Economic Fallout

The proposed acquisition was initially lauded by market analysts for its potential to inject fresh capital, advanced technology, and global expertise into U.S. Steel. Nippon Steel, already the fourth-largest steel producer globally, viewed the acquisition as a critical step to increase its presence in North America — a region where steel demand remains resilient due to infrastructure spending and defense contracts.

However, the Biden administration’s opposition was swift and unequivocal. The White House cited national security concerns and the strategic nature of domestic steel manufacturing. The administration’s stance aligns with a broader protectionist approach that aims to safeguard critical industries from foreign control, particularly in sectors tied to defense and national infrastructure.

The decision has already impacted investor confidence and has the potential to deter future foreign direct investment (FDI) into U.S.-based manufacturing.

Quick Facts

Deal Value: $14.9 billion proposed by Nippon Steel

Jobs at Stake: ~15,000 across key U.S. states including Pennsylvania

Timeline: Deal proposed in late 2023; blocked by Biden in early January 2024

Geopolitical Risk: Elevated due to U.S. industrial policy and election year dynamics

Market Reaction and Expert Commentary

Financial markets reacted cautiously. Shares of U.S. Steel experienced volatility amid legal and regulatory uncertainty, while Nippon Steel's Tokyo-listed stock remained largely stable, reflecting muted investor expectations for the U.S. deal. Analysts from JPMorgan and Goldman Sachs noted that blocking the acquisition could lead to underutilized assets and hinder innovation in the domestic steel sector.

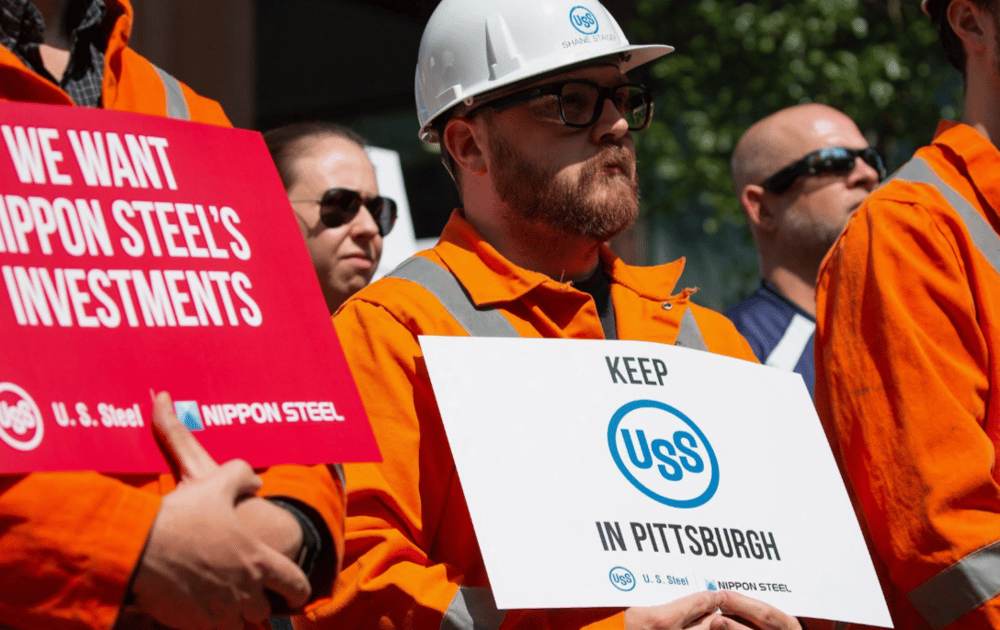

Labor unions initially praised Biden's intervention, emphasizing the importance of retaining U.S. ownership. However, some business coalitions criticized the decision as short-sighted, suggesting it may chill future foreign capital inflow into key sectors.

Key Takeaways

National Security Justification: The Biden administration framed the block as essential for safeguarding domestic production.

Economic Impact: Risk of reduced investment and stagnation in U.S. steel innovation.

Political Dimension: The decision plays well with labor groups and protectionist voters ahead of the 2024 election.

Global Business Risk: Signals increased scrutiny for foreign companies acquiring U.S. strategic assets.

Regional Implications: Pennsylvania and Midwest economies may suffer from deal fallout and prolonged uncertainty.

The Broader Significance of a Blocked Deal

The halted Nippon Steel–U.S. Steel acquisition is more than a failed merger. It is a signal of shifting tides in U.S. industrial policy, where foreign investment is now weighed against domestic resilience and strategic autonomy. As the global economy becomes more fractured along geopolitical lines, corporate transactions — even in traditional sectors like steel — are increasingly influenced by national politics.

Whether this move protects American workers or stifles industrial modernization remains to be seen. What is certain is that the U.S. government is willing to take a strong stance when strategic assets are on the table.

Comments