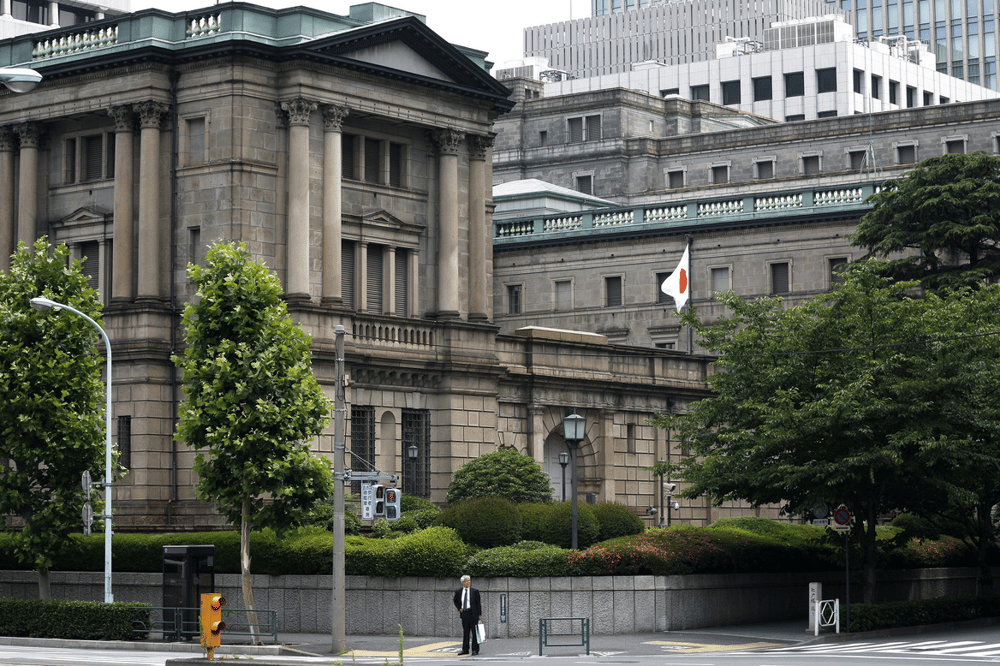

Bank of Japan Raises Bond Loss Reserve to 100%: Implications for Monetary Policy and Financial Stability

As central banks worldwide tighten monetary policy in response to persistent inflation, the Bank of Japan (BOJ) stands out for maintaining one of the most accommodative stances among developed economies. In a significant shift, however, the BOJ has set aside the maximum possible reserve—100%—to cover potential losses from its bond holdings in fiscal year 2024, signaling deeper concerns about the impact of rising interest payments on its capital position.

This unprecedented move comes as Japan’s central bank continues to walk a fine line: upholding financial stability while managing growing pressure on the Japanese yen (JPY) and responding to global interest rate dynamics.

What the BOJ’s 100% Loss Reserve Really Means

According to Nikkei, the BOJ's decision to fully reserve for bond-related losses reflects expectations of increased interest payments to financial institutions—an outcome of the central bank’s vast holdings of government bonds. As global yields rise, the market value of bonds declines, resulting in potential unrealized losses that now require more proactive accounting measures.

Despite these pressures, the BOJ maintained its benchmark short-term interest rate at 0.5% during its May policy meeting. While this level remains historically low, in the Japanese context it represents a meaningful shift—and a more expensive environment for the central bank’s liabilities, including reverse repo operations and interest payments on excess reserves held by commercial banks.

Key Takeaways at a Glance:

Full 100% reserve set for potential bond losses in fiscal 2024

Triggered by expectations of rising interest payments to financial institutions

Reflects market value losses on bonds amid rising global yields

Short-term rate held at 0.5% during May 2024 policy meeting

Focus on preserving the BOJ’s capital base

Market Response and Strategic Signals

Financial markets responded cautiously to the BOJ’s move, as the central bank refrained from an actual rate hike. However, analysts interpret this shift in reserve policy as a strategic prelude to potential monetary tightening. By increasing its loss provisions, the BOJ appears to be preparing its balance sheet for a more volatile interest rate environment—potentially marking the beginning of a long-anticipated policy normalization.

For over two decades, Japan has relied on ultra-loose monetary policy to stimulate growth and combat deflation. But this era may be drawing to a close. Mounting depreciation pressure on the JPY and rising global yields make it harder for the BOJ to remain dovish without consequences for financial and currency stability.

Five Key Insights:

100% provisioning marks a first in BOJ history

Interest rates remain unchanged, despite growing speculation

Preparation for policy normalization implied through risk provisioning

Capital protection takes center stage in central bank strategy

Increasing pressure on the JPY may influence future rate decisions

A Structural Shift Beneath the Surface

The Bank of Japan’s decision to fully reserve for potential bond losses signals more than just a technical accounting adjustment—it reflects a strategic pivot in response to emerging risks from prolonged monetary easing. While the official interest rate remains unchanged, the move sends a clear message to markets: the central bank is recalibrating its risk posture amid a shifting global financial landscape.

As the U.S. Federal Reserve (USD), the European Central Bank (EUR), and the Bank of England (GBP) maintain or raise rates, even indirect signals from the BOJ are closely watched. The full reserve coverage highlights a growing awareness within Japan’s central bank that maintaining ultra-low rates indefinitely may no longer be sustainable.

For global investors and policy analysts, the implications are clear: Japan is quietly laying the groundwork for potential monetary tightening, and any future steps from the BOJ could ripple through Asian bond markets, currency valuations, and broader investment flows.

Comments

Strategic shifts like this are setting new standards in an increasingly automated world