Bank Indonesia Cuts Reserve Requirements, Releases IDR 78.45 Trillion in Liquidity to Support Growth

In a bid to bolster domestic liquidity and fuel economic momentum, Bank Indonesia (BI) announced a reduction in secondary reserve requirements from 5% to 4%, effective June 2025. This adjustment is expected to unlock approximately IDR 78.45 trillion (USD 4.84 billion) for banks, enhancing flexibility in credit allocation and liquidity management.

The move complements a broader monetary easing cycle, as Indonesia's central bank has already cut interest rates three times since September. As Southeast Asia’s largest economy navigates global headwinds and regional volatility, the central bank’s actions signal a proactive stance aimed at maintaining domestic financial stability while incentivizing lending.

Implications of Lower Reserve Requirements for Indonesia’s Financial Sector

The decision by Bank Indonesia to lower the secondary reserve ratio is part of a macroprudential framework designed to ease systemic liquidity constraints. The freed-up capital provides banks with additional tools to expand credit to the real sector, particularly small and medium enterprises (SMEs), which remain the backbone of Indonesia's economy.

Solikin M. Juhro, BI’s Head of Macroprudential Policy, emphasized that the reduction aims to optimize liquidity distribution within the banking system. He underscored that this liquidity boost will not compromise monetary stability, as primary reserve requirements remain unchanged.

By aligning reserve policies with recent rate cuts, BI is reinforcing its commitment to supporting economic growth amid a cautious global environment. The policy shift also coincides with a softening of global commodity prices and subdued export demand, factors that have placed pressure on Indonesia’s GDP expansion in recent quarters.

Quick Facts

Policy Change: Secondary reserve ratio cut from 5% to 4%

Liquidity Impact: IDR 78.45 trillion (USD 4.84 billion) released into banking system

Effective Date: June 2025

Macroeconomic Goal: Stimulate credit and growth in key domestic sectors

Rate Context: Third interest rate cut since September 2024

Market Reactions and Expert Commentary

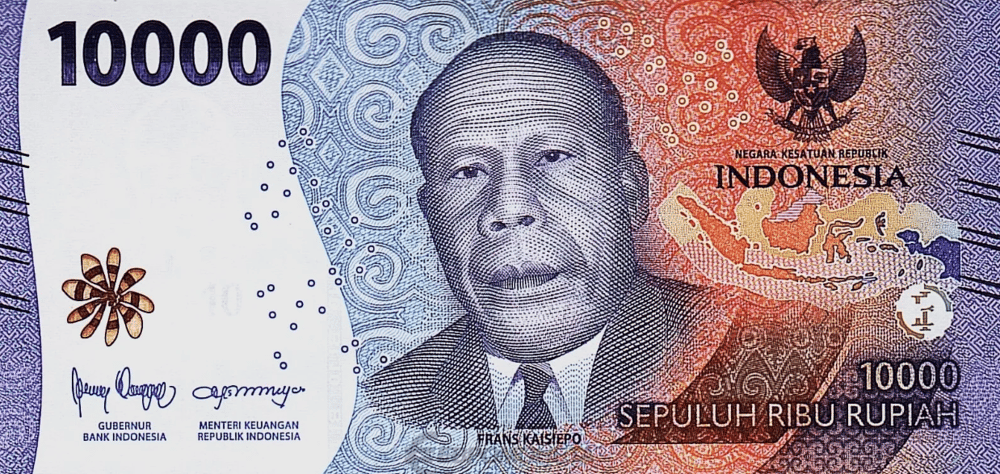

Financial markets reacted cautiously optimistic to Bank Indonesia’s latest measures. The Indonesian rupiah (IDR) remained relatively stable against the U.S. dollar (USD), signaling market confidence that the central bank’s liquidity injection would not immediately stoke inflation or currency volatility.

Economists note that the reserve requirement adjustment provides short-term relief to banks managing funding costs in a lower interest rate environment. However, some analysts caution that increased liquidity alone may not be sufficient to accelerate lending if demand from businesses and consumers remains tepid.

From a regulatory perspective, BI’s move is consistent with global trends, where central banks are prioritizing financial flexibility amid slower global trade, tight monetary conditions abroad, and moderating inflation.

Key Points

Liquidity injection of USD 4.84 billion improves bank balance sheet flexibility.

Monetary easing strategy supports lending without altering inflation trajectory.

Reserve ratio adjustment reinforces Bank Indonesia’s macroprudential toolkit.

Market reaction muted but signals cautious optimism.

Real economy impact will depend on transmission through credit channels.

Strategic Liquidity Easing as a Growth Lever

Bank Indonesia’s calibrated reduction in secondary reserve requirements underscores its dual objective of maintaining monetary stability while invigorating economic activity. By synchronizing liquidity measures with benchmark rate cuts, BI is building a comprehensive easing strategy suited to Indonesia’s evolving macroeconomic landscape.

The liquidity release of IDR 78.45 trillion represents a critical signal to domestic banks: capital should be actively deployed to support real-sector growth rather than parked in idle reserves. As Indonesia positions itself for sustained recovery, the success of these policies will hinge on their ability to stimulate productive lending, not merely improve bank liquidity ratios.

Comments

BI's decision to cut secondary reserve requirements is a smart move that could really energize the economy!

Forward-thinking investments like this are reshaping how innovation scales in tech