Super Micro Computer Commits to Transparency and Innovation

Super Micro Computer $SMCI has announced plans to submit delayed annual and quarterly reports to the U.S. Securities and Exchange Commission (SEC) by February 25.

Super Micro Computer, a major server manufacturer, stated that it expects to file its delayed reports by the end of February, leading to a more than 8% increase in the company's stock after market close. This significant move comes in response to document requests from the U.S. Department of Justice and the SEC following allegations of reporting manipulation by short-seller firm Hindenburg Research in August.

Cooperation with Authorities

The San Jose-based company is actively cooperating with authorities to resolve the current situation. The ongoing collection and submission of requested documents are part of a broader strategy to enhance transparency and build trust with investors and partners.

Super Micro Computer also revised its annual revenue forecast due to delays in Nvidia $NVDA processor releases, according to the company’s CFO, David Weigand. While the delayed 10-K report filing was a "distraction," the company is focusing primarily on the technological delays.

Full AI Systems Production Readiness

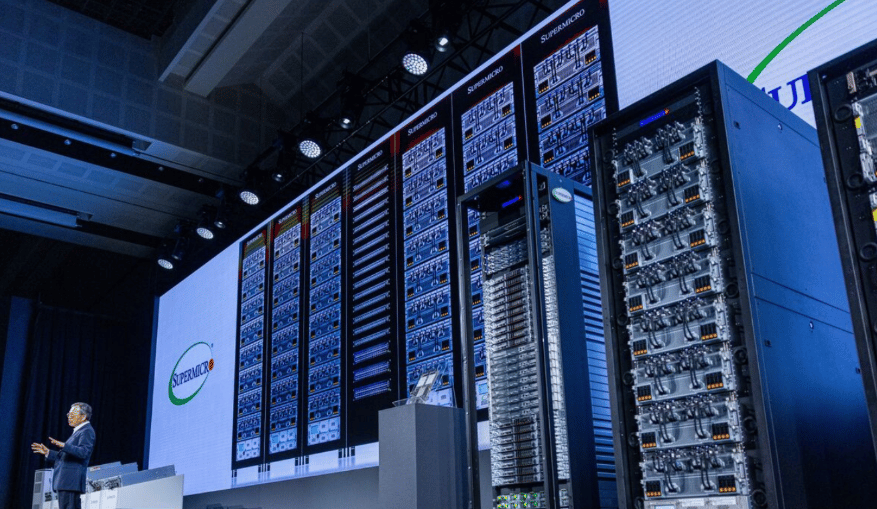

The company announced full readiness for manufacturing server systems based on Nvidia Blackwell, demonstrating its commitment to adopting new technologies and supporting advanced data center architecture. This is particularly relevant for meeting the complex computing demands of artificial intelligence (GenAI).

Competitive Challenges and Sales Forecast

Super Micro Computer is facing increased competition from companies such as:

- Dell $DELL

- HP Enterprise $HPE

These companies are also actively developing their solutions in the data center and AI fields.

Revenue Forecast

Super Micro projects net sales between $23.5 billion and $25 billion for the fiscal year 2025. This forecast is lower than the previous range of $26 billion to $30 billion, reflecting current market and technological challenges.

Super Micro Computer is diligently working to improve report transparency and continues to implement innovations in its technological solutions. Amid increasing competition, the company is focusing on adapting new technologies and reinforcing trust with regulators and investors. The upcoming company report is expected to provide further confidence in their strategy and future growth.

Strategic decisions to optimize business operations have the potential to drive the company’s market valuation upward

Embracing state-of-the-art solutions builds investor confidence and aligns with market expectations for growth

Continuous business model experimentation equips the company with the agility to capitalize on emerging market opportunities

The successful testing of modern business solutions sends a positive signal to investors about the company’s forward-thinking leadership

It's encouraging to see Super Micro taking steps to address these concerns and restore investor confidence.