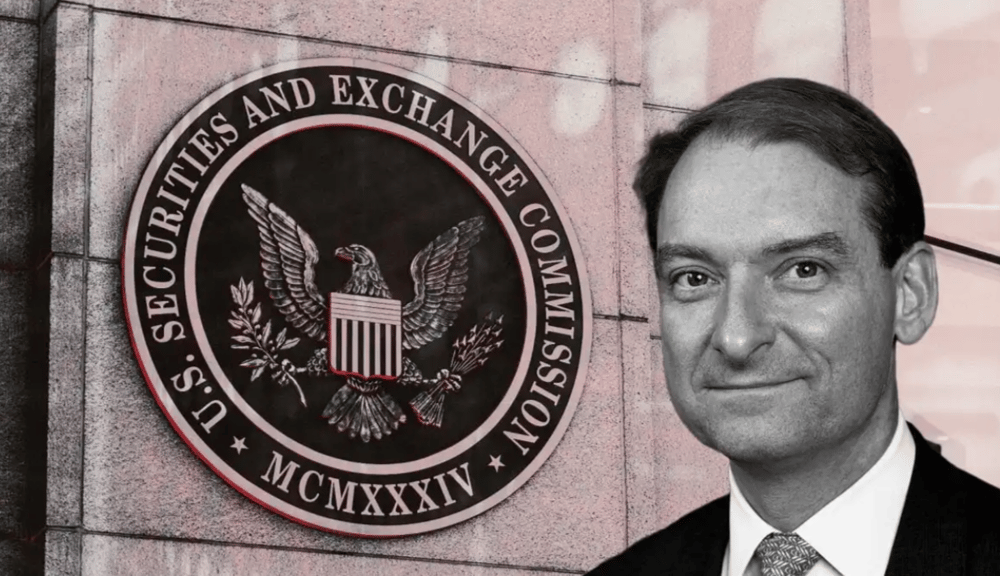

Paul Atkins Sworn in as SEC Chair: Prioritizing a Stable Framework for Digital Assets

Paul Atkins has officially taken office as the Chair of the Securities and Exchange Commission (SEC) in a ceremony held at the White House on Tuesday. His appointment comes at a crucial time when regulatory clarity around digital assets is becoming increasingly imperative. Atkins emphasized that his primary objective will be to establish a robust framework for the governance of digital assets while ensuring that politics do not interfere with the securities legislation process.

Key Focus Areas for SEC Under Paul Atkins

Atkins' ascension to the SEC chairmanship signals a potential shift in regulatory priorities. Here are the main areas he aims to address:

Digital Asset Regulation:

Creating a solid and clear regulatory framework for digital assets will be a focal point. Given the rapid evolution of cryptocurrencies and blockchain technologies, establishing guidelines that both protect investors and encourage innovation is essential.

Politics-Free Legislation:

Atkins expressed his commitment to removing political influences from securities regulation, which could promote a more stable and predictable environment for market participants.

Strategies to Pursue Regulatory Goals

Stakeholder Engagement:

Actively engaging with industry stakeholders, including technology developers and financial institutions, will be crucial for understanding the nuances of digital asset markets.

Clarity in Classification:

Distinguishing between different types of digital assets (e.g., cryptocurrencies, tokens, and securities) will facilitate better regulatory measures and provide clarity for investors.

Potential Challenges Ahead

Market Volatility:

The digital asset market is known for its volatility, which presents challenges in creating regulations that can adapt to rapid changes while protecting investors.

Balancing Innovation and Regulation:

Striking the right balance between fostering innovation in the burgeoning digital asset sector and ensuring adequate investor protection is a complex task that will require careful consideration.

Conclusion

With Paul Atkins at the helm of the SEC, there is a distinct focus on laying down a comprehensive regulatory framework for digital assets. His commitment to minimizing political influence in securities legislation could pave the way for a more stable and predictable regulatory environment. As the digital asset landscape continues to evolve, the SEC's approach under Atkins will be instrumental in shaping the future of the market and maintaining investor confidence.

This kind of sale has the potential to transform automation trends across the tech sector

A transaction of this scale could significantly influence the way automation evolves within the tech industry