International Risks Will Impact S&P 500 Companies’ Revenues

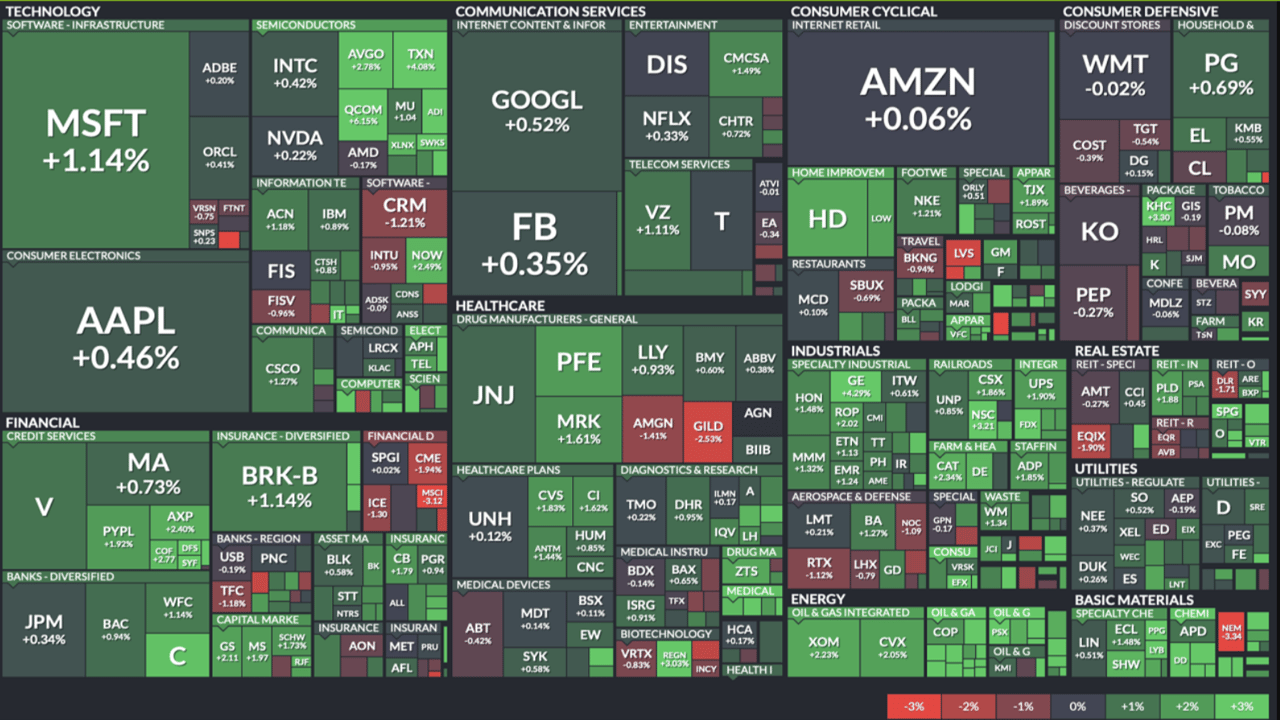

Global economic trends are increasingly influencing U.S. companies, particularly those in $^SPX. Approximately 41% of their revenues come from international markets, making these firms highly vulnerable to economic shifts outside the United States. The threat of a recession in Europe and the ongoing slowdown of the Chinese economy have emerged as significant risks for American corporations.

Dependence on Global Markets

U.S. companies have long relied on international markets for revenue growth, with Europe and China being the two largest regions contributing significantly to profits. However, current economic challenges in these regions could severely impact consumer purchasing power and lead to reduced export flows.

The slowdown in China is a growing concern for investors and analysts. The country is not only a key market for many American products and services, but also an integral partner in global supply chains. A slowdown in China's growth could lead to lower demand for products from S&P 500 companies.

In Europe, the risk of recession is rising due to high energy prices, economic stagnation, and inflation. A weakening European economy will likely reduce demand for American goods and services.

What Are the Potential Impacts on the S&P 500?

Companies that rely heavily on international sales could see reduced profits and lower revenue forecasts, which would negatively affect their stock prices. This, in turn, would impact the entire S&P 500 index, a key benchmark for the U.S. economy.

Sectors most vulnerable to global conditions, such as technology, industrials, and consumer goods, will face heightened risk. For example, global tech giants that produce electronics or software are already under pressure due to falling demand in China. Similarly, the automotive industry could suffer losses due to slowing purchases in Europe.

Global Instability and Geopolitical Influence

The economic situation in Europe and China is also affected by geopolitical factors. Rising tensions between the U.S. and China, along with trade restrictions and tariffs, are forcing companies to rethink their strategies for cross-border supply chains. Should political tensions escalate further, American companies may find it increasingly difficult to maintain their positions in international markets.

In Europe, the energy crisis and the ongoing impact of military conflicts add another layer of instability. If the recession in European countries deepens, the export revenues of S&P 500 companies could be hit even harder.

What Does This Mean for the Global Economy?

A reduction in the revenues of S&P 500 companies will not only lead to a drop in their stock prices but could also shake investor confidence. The S&P 500 is seen as a barometer of the stability of the U.S. economy, meaning even minor disruptions in global earnings could have long-term consequences for the world financial system.

There is also the risk of a ripple effect, where economic slowdowns in Europe and China begin to impact each other, delivering a double blow to the global economy. In this scenario, American corporations will be forced to adapt to new conditions, potentially seeking new markets in regions like Southeast Asia or emerging markets.

Conclusion

The ongoing global economic turbulence and geopolitical risks underscore the interconnected ness of markets worldwide. As the economies of Europe and China face mounting challenges, U.S. companies in the S&P 500 may need to brace for a tougher business environment. Their ability to navigate these international risks will play a crucial role in maintaining economic stability, not only for the U.S. but for the broader global economy.

Comments

nice news