EU-China Rare Earths and Critical Minerals Access Negotiations Amid Rising Trade Tariffs

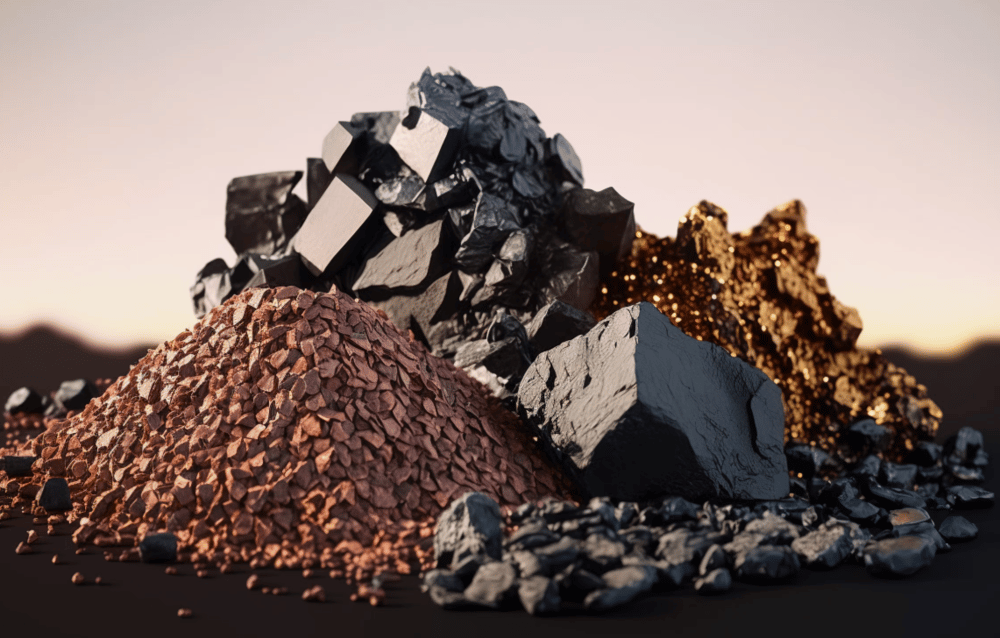

European Union leaders are preparing for a pivotal summit with China next month, aiming to secure improved access to Chinese rare earths and critical minerals. These materials, essential for industries such as automotive manufacturing, defense, and renewable energy production, have increasingly become a focal point in international trade negotiations. China’s dominant position in rare earth production and its tightened export controls have heightened urgency for the EU to diversify supply chains and reduce dependency.

This development occurs against the backdrop of escalating trade tensions, especially after the U.S. imposed tariffs on Chinese goods in early April, complicating global trade dynamics and prompting ripple effects in resource accessibility.

Impact of China’s Export Controls and EU Strategic Responses

China holds approximately 60-70% of the global rare earth production capacity, making its export policies critical to global supply chains. In response to the U.S. tariffs announced by President Donald Trump on April 2, China escalated export restrictions on rare earth elements and critical minerals. This move has disrupted industries worldwide that rely on these minerals for manufacturing electric vehicles (EVs), defense equipment, and clean energy technologies such as wind turbines and solar panels.

For the EU, the supply bottleneck poses significant risks. Rare earth elements, including neodymium, dysprosium, and terbium, are indispensable in producing high-performance magnets and batteries. The EU’s automotive sector, led by companies like Volkswagen $VWAGY and Renault $RNO.PA, and defense manufacturers depend heavily on steady mineral supplies to meet production goals and innovation targets.

The upcoming summit represents an opportunity for the EU to negotiate terms that could ease these export restrictions and ensure a more reliable supply chain, reducing geopolitical risks and bolstering industrial resilience.

Quick Facts

🌍 China dominates 60-70% of global rare earth production.

🚗 EU automakers heavily depend on rare earths for EV manufacturing.

⚔️ Defense industry and renewable energy sectors require critical minerals for advanced technologies.

📉 China tightened export controls following U.S. tariffs announced on April 2.

🇪🇺 EU seeks improved mineral access at upcoming summit with China.

Market Reaction and Industry Implications

The announcement of China's export restrictions has sent ripples through global commodity markets. Prices for rare earth elements have surged as buyers scramble to secure supplies amid fears of shortages. Mining companies in regions like Australia and the U.S., including Lynas Corporation $LYC.AX, have seen renewed investor interest as efforts to diversify supply chains accelerate.

EU officials have publicly emphasized the strategic necessity to reduce dependency on Chinese rare earths, with initiatives to boost domestic mining and recycling gaining momentum. However, the current dependency remains substantial, underscoring the importance of diplomatic engagement.

Key Points

China's export control escalation has tightened global rare earth supply.

EU industries face risks to production, particularly in EVs and defense sectors.

Commodity prices for rare earth elements have increased sharply.

Diversification efforts include EU domestic mining and recycling initiatives.

The upcoming EU-China summit is critical for negotiating mineral access and trade terms.

Strategic Significance of EU-China Rare Earth Negotiations

The rare earth and critical minerals negotiations between the EU and China encapsulate broader geopolitical and economic tensions within global supply chains. Securing stable access to these resources is vital for Europe's industrial competitiveness and energy transition goals. As tariffs and trade barriers continue to shape international relations, the outcomes of this summit will significantly influence the EU’s capacity to safeguard its supply chains and maintain leadership in emerging technologies.

Comments

It's about time the EU takes steps to secure its critical mineral supply and reduce reliance on China.

The EU's push for better access to rare earths is a crucial step toward a more resilient and independent supply chain.