American Express Unveils Major Platinum Card Upgrades Amid Shifting Consumer Trends

American Express $AXP announced a sweeping update to its U.S. consumer and business Platinum® Cards, marking the most significant overhaul in the product’s four-decade history. This strategic move comes at a time when evolving preferences among Millennials and Gen Z are reshaping spending patterns, particularly across travel, dining, and lifestyle categories.

In the latest quarter, younger generations accounted for 35% of all U.S. consumer spending—a demographic shift that American Express is actively targeting through both functional upgrades and aesthetic redesigns of its premium product line.

Strategic Investment in Platinum Card Benefits and Positioning

The planned changes represent not just a product refresh but a broader pivot in American Express's positioning strategy. By focusing on experiential value and personalized perks, the company aims to reinforce the Platinum Card’s appeal in an increasingly competitive premium credit card market dominated by players such as JPMorgan Chase $JPM and Capital One $COF.

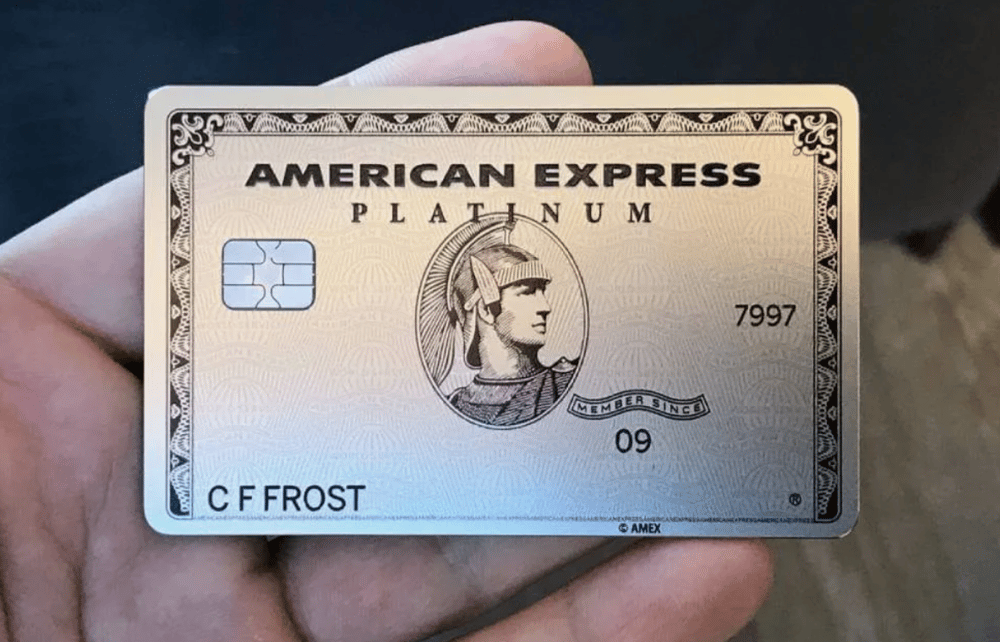

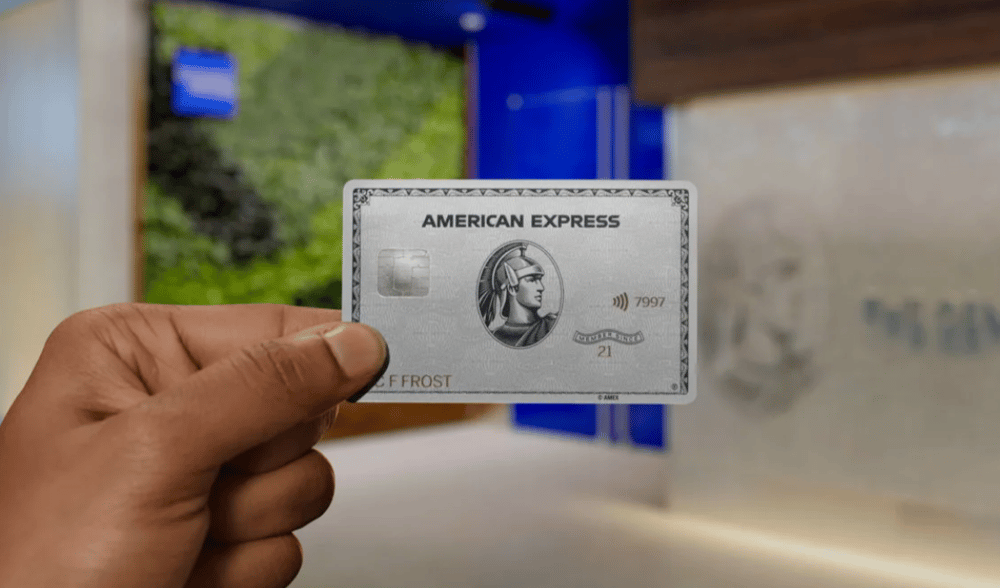

The upgrades will include new benefits in travel loyalty, dining credits, exclusive access to lifestyle events, and a redesigned card aesthetic aimed at enhancing brand engagement and physical card experience. These features cater to a generation that prioritizes experiences over possessions, while also demanding seamless digital integration.

From a corporate strategy perspective, this marks one of American Express’s largest investments in its cardmember base. It reflects a dual objective: retain high-spending legacy users and attract affluent young professionals, who are increasingly seeking value-added services from their financial providers.

Quick Facts:

💳 The Platinum Card® was first launched over 40 years ago and has become a symbol of elite customer service and premium rewards.

📊 Millennials and Gen Z made up 35% of U.S. consumer spending last quarter, according to internal AXP data.

✈️ New benefits emphasize travel, dining, and lifestyle rewards—key categories for younger cardholders.

💼 Updates extend across both consumer and business Platinum product lines.

🎯 The redesign includes new card materials and visuals aligned with modern luxury aesthetics.

Extended Analysis: Market Reactions and Expert Insights on AXP Strategy

Following the announcement, analysts have generally reacted positively, seeing the move as a proactive effort to future-proof AXP’s premium portfolio in light of generational changes and fintech competition. The company's willingness to reinvest in a mature product suggests confidence in the long-term relevance of physical credit cards—even in an era of mobile wallets and digital payments.

Market watchers note that the upgrades align well with the broader industry trend of experience-driven loyalty programs. American Express’s existing partnerships—with airlines, hotel groups (e.g., Hilton, Marriott), and entertainment platforms—position it to enhance customer stickiness and justify higher annual fees.

Analysts from Goldman Sachs $GS and Morgan Stanley $MS view the initiative as potentially margin-accretive in the medium term, assuming the revamped benefits increase card retention rates and new sign-ups in target segments.

Key Takeaways:

Generational spending shifts are redefining the premium card market.

American Express is investing in both features and form to appeal to younger, experience-driven consumers.

Strategic focus on travel and lifestyle ecosystems aligns with competitive trends.

The redesign supports brand elevation amid intensifying digital competition.

Positive analyst sentiment suggests the upgrades could drive long-term customer loyalty and revenue growth.

American Express Reinforces Its Position in the Premium Card Segment

American Express’s bold move to overhaul its Platinum Card line is a calculated response to changing demographic and behavioral patterns among U.S. consumers. By blending digital-savvy features, premium experiences, and luxury design, AXP is positioning itself at the intersection of tradition and innovation.

This announcement underscores a strategic inflection point not only for American Express but for the broader credit card industry. As fintech disruptors challenge legacy models, traditional players must evolve or risk obsolescence. AXP's approach exemplifies how legacy financial brands can remain relevant through targeted reinvestment and customer-centric design thinking.

Comments

The tech landscape is clearly pivoting toward automation as a core growth engine